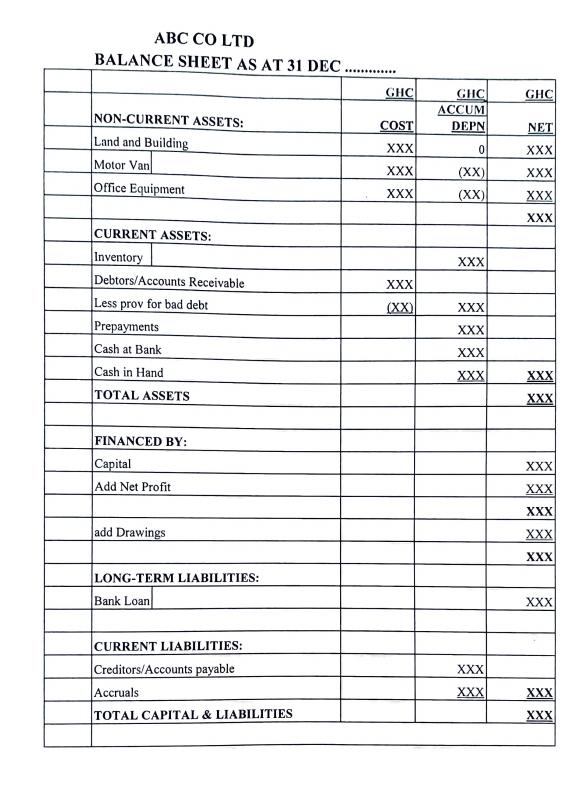

Question: How do we recorded the omitted ones? Kindly solve using the format given. . ABC CO LTD BALANCE SHEET AS AT 31 DEC NON-CURRENT ASSETS:

How do we recorded the omitted ones? Kindly solve using the format given.

.

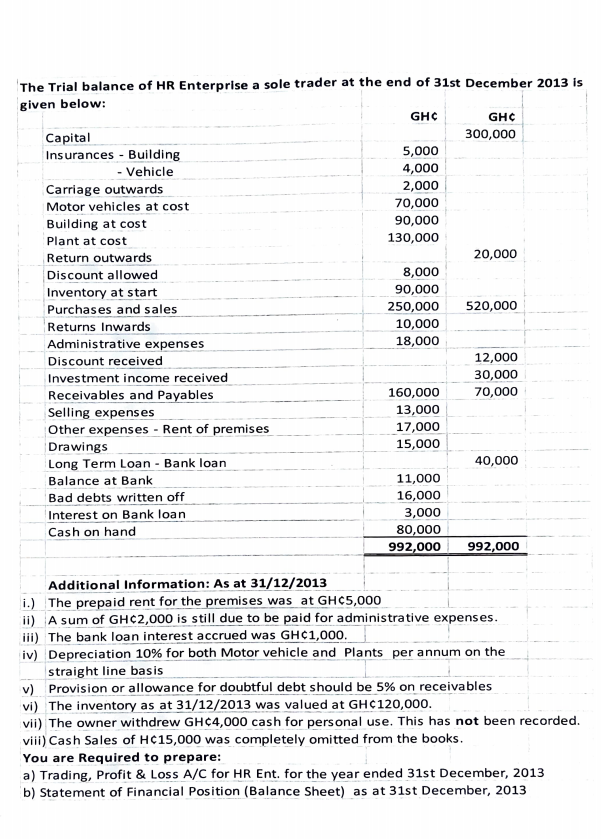

ABC CO LTD BALANCE SHEET AS AT 31 DEC NON-CURRENT ASSETS: Land and Building Motor Van Office Equipment CURRENT ASSETS: Inventory Debtors/Accounts Receivable Less prov for bad debt Prepayments Cash at Bank Cash in Hand TOTAL ASSETS FINANCED BY: Capital Add Net Profit add Drawings LONG-TERM LIABILITIES: Bank Loan CURRENT LIABILITIES: Creditors/Accounts payable Accruals TOTAL CAPITAL & LIABILITIES ************* GHC COST XXX XXX XXX XXX (XX) GHC ACCUM DEPN 0 (XX) (XX) XXX XXX XXX XXX XXX XXX XXX GHC NET XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX ABC CO LTD BALANCE SHEET AS AT 31 DEC NON-CURRENT ASSETS: Land and Building Motor Van Office Equipment CURRENT ASSETS: Inventory Debtors/Accounts Receivable Less prov for bad debt Prepayments Cash at Bank Cash in Hand TOTAL ASSETS FINANCED BY: Capital Add Net Profit add Drawings LONG-TERM LIABILITIES: Bank Loan CURRENT LIABILITIES: Creditors/Accounts payable Accruals TOTAL CAPITAL & LIABILITIES ************* GHC COST XXX XXX XXX XXX (XX) GHC ACCUM DEPN 0 (XX) (XX) XXX XXX XXX XXX XXX XXX XXX GHC NET XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX ABC CO LTD BALANCE SHEET AS AT 31 DEC NON-CURRENT ASSETS: Land and Building Motor Van Office Equipment CURRENT ASSETS: Inventory Debtors/Accounts Receivable Less prov for bad debt Prepayments Cash at Bank Cash in Hand TOTAL ASSETS FINANCED BY: Capital Add Net Profit add Drawings LONG-TERM LIABILITIES: Bank Loan CURRENT LIABILITIES: Creditors/Accounts payable Accruals TOTAL CAPITAL & LIABILITIES ************* GHC COST XXX XXX XXX XXX (XX) GHC ACCUM DEPN 0 (XX) (XX) XXX XXX XXX XXX XXX XXX XXX GHC NET XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX The Trial balance of HR Enterprise a sole trader at the end of 31st December 2013 is given below: GHC GHC Capital 300,000 Insurances - Building 5,000 - Vehicle 4,000 Carriage outwards 2,000 Motor vehicles at cost 70,000 Building at cost 90,000 130,000 Plant at cost Return outwards Discount allowed 20,000 8,000 Inventory at start 90,000 250,000 520,000 Purchases and sales Returns Inwards 10,000 Administrative expenses 18,000 Discount received 12,000 Investment income received 30,000 Receivables and Payables 160,000 70,000 Selling expenses 13,000 Other expenses - Rent of premises 17,000 Drawings 15,000 40,000 11,000 Long Term Loan - Bank loan Balance at Bank Bad debts written off Interest on Bank loan Cash on hand 16,000 3,000 80,000 992,000 992,000 Additional Information: As at 31/12/2013 i.) The prepaid rent for the premises was at GHC5,000 ii) A sum of GHC2,000 is still due to be paid for administrative expenses. iii) The bank loan interest accrued was GH1,000. iv) Depreciation 10% for both Motor vehicle and Plants per annum on the straight line basis v) Provision or allowance for doubtful debt should be 5% on receivables vi) The inventory as at 31/12/2013 was valued at GH120,000. vii) The owner withdrew GHC4,000 cash for personal use. This has not been recorded. viii) Cash Sales of H15,000 was completely omitted from the books. You are Required to prepare: a) Trading, Profit & Loss A/C for HR Ent. for the year ended 31st December, 2013 b) Statement of Financial Position (Balance Sheet) as at 31st December, 2013 Die

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts