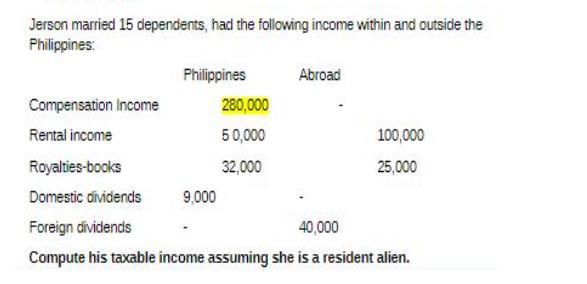

Question: Jerson married 15 dependents, had the following income within and outside the Philippines: Philippines Compensation Income Rental income Royalties-books Domestic dividends Foreign dividends 40,000

Jerson married 15 dependents, had the following income within and outside the Philippines: Philippines Compensation Income Rental income Royalties-books Domestic dividends Foreign dividends 40,000 Compute his taxable income assuming she is a resident alien. 9,000 Abroad 280,000 50,000 32,000 100,000 25,000

Step by Step Solution

There are 3 Steps involved in it

To compute Jersons taxable income as a resident alien we need to consider the different types of inc... View full answer

Get step-by-step solutions from verified subject matter experts