Question: how do you answer this question? Monash University - My Appl x my.monash Course: MCD2080 Business P Do Homework - Joel Andrew X P Do

how do you answer this question?

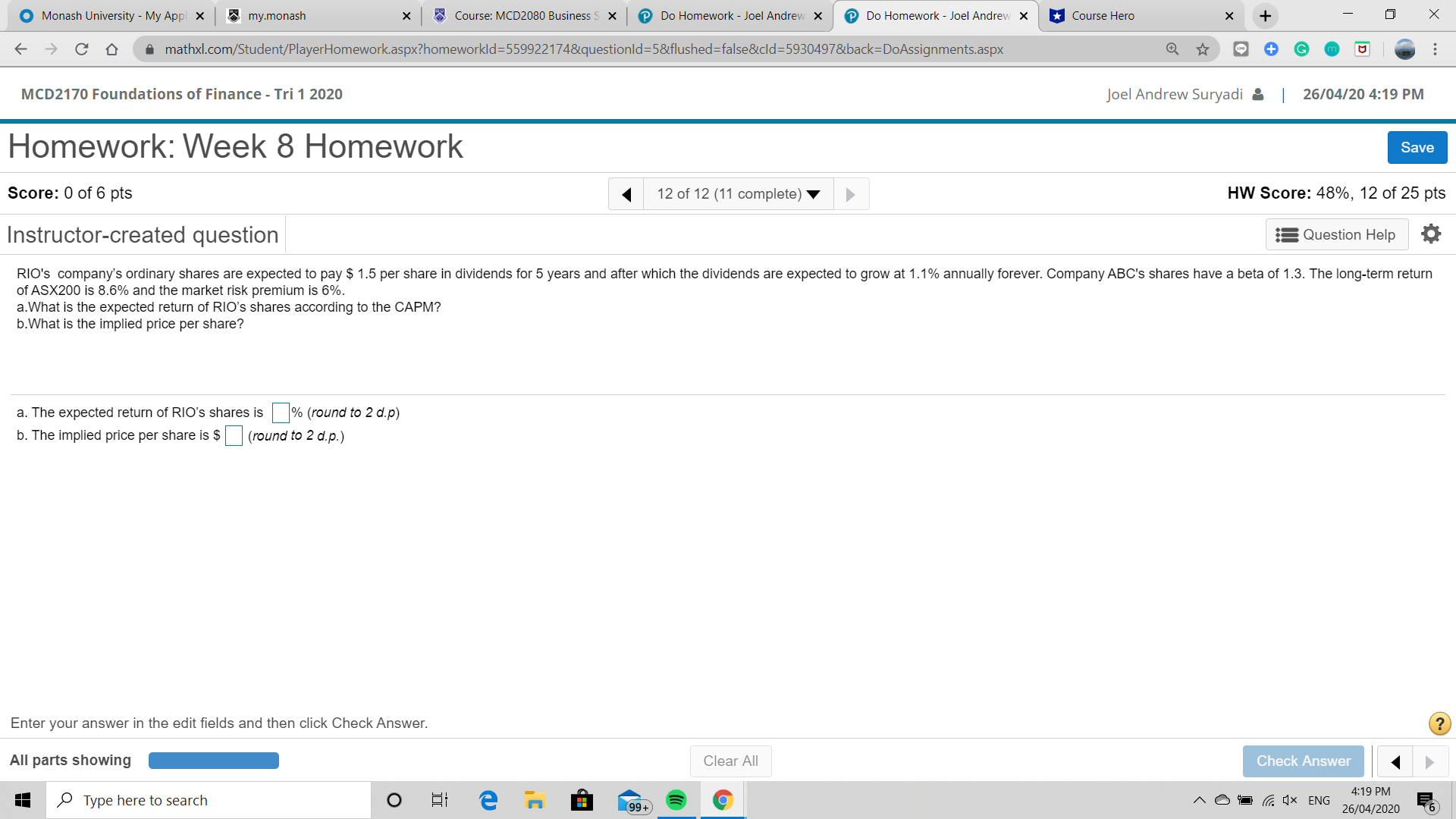

Monash University - My Appl x my.monash Course: MCD2080 Business P Do Homework - Joel Andrew X P Do Homework - Joel Andrew X Course Hero mathxl.com/Student/PlayerHomework.aspx?homeworkId=559922174&questionid=5&flushed=false&cid=5930497&back=DoAssignments.aspx MCD2170 Foundations of Finance - Tri 1 2020 x + Joel Andrew Suryadi | 26/04/20 4:19 PM Homework: Week 8 Homework Score: 0 of 6 pts Instructor-created question 12 of 12 (11 complete) Save HW Score: 48%, 12 of 25 pts Question Help RIO's company's ordinary shares are expected to pay $ 1.5 per share in dividends for 5 years and after which the dividends are expected to grow at 1.1% annually forever. Company ABC's shares have a beta of 1.3. The long-term return of ASX200 is 8.6% and the market risk premium is 6%. a. What is the expected return of RIO's shares according to the CAPM? b. What is the implied price per share? a. The expected return of RIO's shares is % (round to 2 d.p) b. The implied price per share is $ (round to 2 d.p.) Enter your answer in the edit fields and then click Check Answer. All parts showing Type here to search T e C (99+ ? Clear All Check Answer ENG 4:19 PM 26/04/2020 6

Step by Step Solution

There are 3 Steps involved in it

The question asks you to calculate the expected return and implied price per share of RIOs companys ordinary shares using the Capital Asset Pricing Model CAPM Heres how to answer the question a Expect... View full answer

Get step-by-step solutions from verified subject matter experts