Question: How do you calculate COGS ? Step by step The Williams Company sells a product called Mix-Right for $15 each and uses a perpetual inventory

How do you calculate COGS ?

Step by step

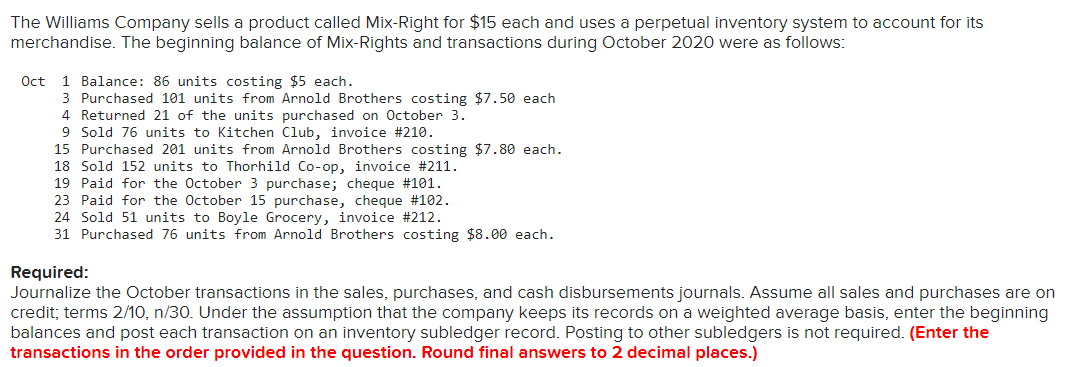

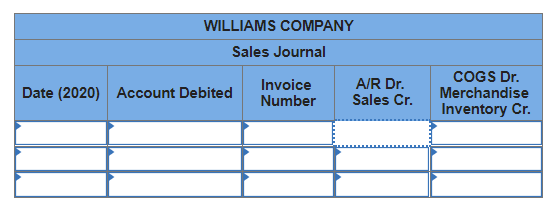

The Williams Company sells a product called Mix-Right for $15 each and uses a perpetual inventory system to account for its merchandise. The beginning balance of Mix-Rights and transactions during October 2020 were as follows: Oct 1 Balance: 86 units costing $5 each. 3 Purchased 101 units from Arnold Brothers costing $7.50 each 4 Returned 21 of the units purchased on October 3. 9 Sold 76 units to Kitchen Club, invoice #210. 15 Purchased 201 units from Arnold Brothers costing $7.80 each. 18 Sold 152 units to Thorhild Co-op, invoice #211. 19 Paid for the October 3 purchase; cheque #101. 23 Paid for the October 15 purchase, cheque #102. 24 Sold 51 units to Boyle Grocery, invoice #212. 31 Purchased 76 units from Arnold Brothers costing $8.00 each. Required: Journalize the October transactions in the sales, purchases, and cash disbursements journals. Assume all sales and purchases are on credit; terms 2/10, n/30. Under the assumption that the company keeps its records on a weighted average basis, enter the beginning balances and post each transaction on an inventory subledger record. Posting to other subledgers is not required. (Enter the transactions in the order provided in the question. Round final answers to 2 decimal places.) WILLIAMS COMPANY Sales Journal Invoice A/R Dr. Date (2020) Account Debited Number Sales Cr. COGS Dr. Merchandise Inventory Cr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts