Question: How do you calculate Free Cash Flow? I'm having problems with 7d, e and f. 7 Good ure has released their financial statements for the

How do you calculate Free Cash Flow? I'm having problems with 7d, e and f.

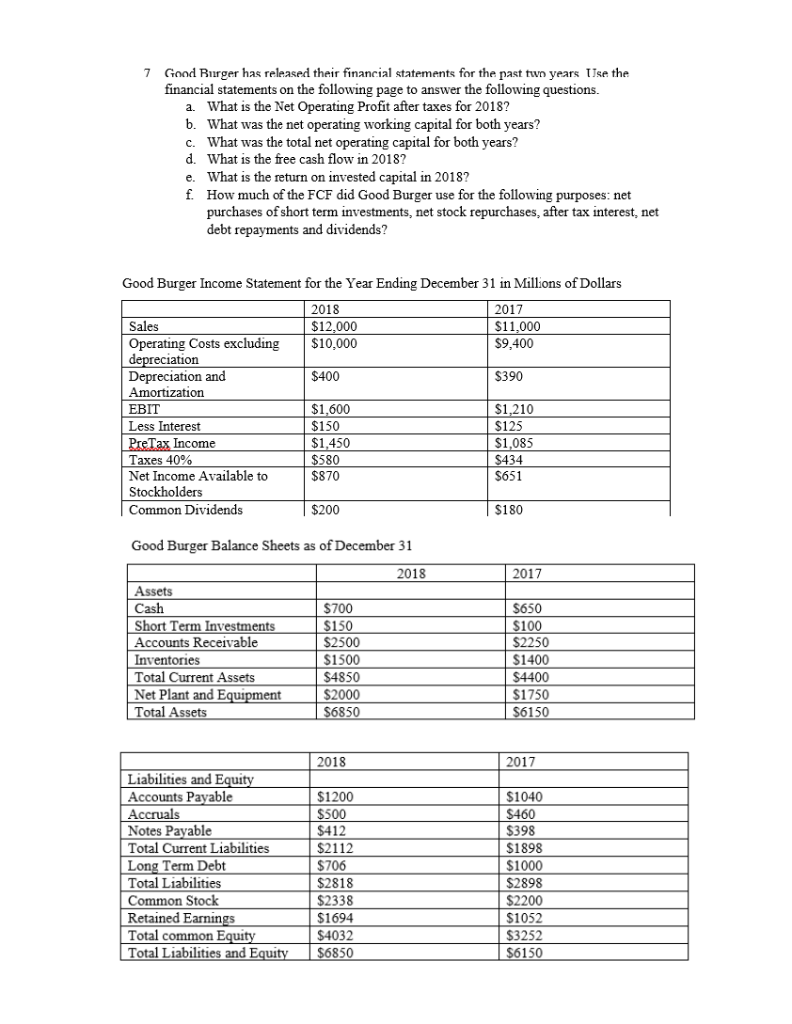

7 Good ure has released their financial statements for the past twn years se the financial statements on the following page to answer the following questions. a. b. c. d. e. f. What is the Net Operating Profit after taxes for 2018? What was the net operating working capital for both years? What was the total net operating capital for What is the free cash flow in 2018? What is the return on invested capital in 2018? How much of the FCF did Good Burger use for the following purposes: net purchases of short term investments, net stock repurchases, after tax interest, net debt repayments and dividends? both years? Good Burger Income Statement for the Year Ending December 31 in Millions of Dollars Sales Operating Costs excluding$10,000 2018 $12,000 2017 11,000 $9,400 Depreciation and Amortization EBIT Less Interest $400 S390 $1,600 $150 $1,450 580 $870 $1.210 $125 S1,085 Income Taxes 40% Net Income Available to Stockholders Common Dividends S651 $200 $180 Good Burger Balance Sheets as of December 31 2018 2017 Assets Cash Short Term Investments Accounts Receivable Inventories Total Current Assets Net Plant and Total Assets $700 150 $2500 $1500 S4850 $2000 685 $650 100 $2250 $1400 $4400 $1750 50 2018 2017 Liabilities and Accounts Payable Accruals Notes Payable Total Current Liabilities Long Term Debt Total Liabilities Common Stock Retained Earnings Total common Total Liabilities and $1200 $500 412 $2112 $706 S2818 $2338 $1694 $4032 S1040 $460 S398 $1898 1000 $2898 2200 S1052 S3252 150 850 7 Good ure has released their financial statements for the past twn years se the financial statements on the following page to answer the following questions. a. b. c. d. e. f. What is the Net Operating Profit after taxes for 2018? What was the net operating working capital for both years? What was the total net operating capital for What is the free cash flow in 2018? What is the return on invested capital in 2018? How much of the FCF did Good Burger use for the following purposes: net purchases of short term investments, net stock repurchases, after tax interest, net debt repayments and dividends? both years? Good Burger Income Statement for the Year Ending December 31 in Millions of Dollars Sales Operating Costs excluding$10,000 2018 $12,000 2017 11,000 $9,400 Depreciation and Amortization EBIT Less Interest $400 S390 $1,600 $150 $1,450 580 $870 $1.210 $125 S1,085 Income Taxes 40% Net Income Available to Stockholders Common Dividends S651 $200 $180 Good Burger Balance Sheets as of December 31 2018 2017 Assets Cash Short Term Investments Accounts Receivable Inventories Total Current Assets Net Plant and Total Assets $700 150 $2500 $1500 S4850 $2000 685 $650 100 $2250 $1400 $4400 $1750 50 2018 2017 Liabilities and Accounts Payable Accruals Notes Payable Total Current Liabilities Long Term Debt Total Liabilities Common Stock Retained Earnings Total common Total Liabilities and $1200 $500 412 $2112 $706 S2818 $2338 $1694 $4032 S1040 $460 S398 $1898 1000 $2898 2200 S1052 S3252 150 850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts