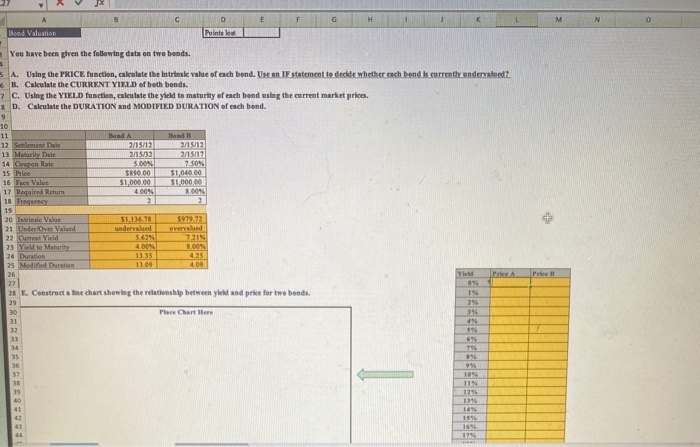

Question: How do you calculate price for A and B based off the yield percentages? D Band Valuation Points You have been given the following data

D Band Valuation Points You have been given the following data on two bonds. SA. Using the PRICE function, calculate the intrinsic value of each bond. Use an IE statement te decide whether each bend is currently undervalued 6 B. Calculate the CURRENT YIELD of both bonds. 7 C. Using the YIELD function, calculate the yield to maturity of each bond using the current market prices. 8 D. Calculate the DURATION and MODIFIED DURATION of each bond. 9 10 11 Band A Band B 12 Setement Date 2/15/12 2/15/12 13 Maturity Dalt 215/32 2/15/12 14 Coupon Bale 5.00 7.50% 15 Price $890.00 51,040.00 16 Face Value $1,000.00 $1,000.00 17 Required Retur 4.00% 8.00% 18 Frequency 2 19 20 Intrinsic Value 51.13678 597972 21 Under Over Vaheed underved 22 Current Yield 5.62 7.21 23 Yield to Maurity 4.000 8.00% 24 Duration 13.35 25 Medified Duration 13.09 4.00 26 YM 27 Price 04 28 E. Constructa line chart showing the relationship between yield and price for two bends. 19 29 16 30 Place Charter 31 32 33 14 78 35 36 994 10% 1194 83 134 14% IS D Band Valuation Points You have been given the following data on two bonds. SA. Using the PRICE function, calculate the intrinsic value of each bond. Use an IE statement te decide whether each bend is currently undervalued 6 B. Calculate the CURRENT YIELD of both bonds. 7 C. Using the YIELD function, calculate the yield to maturity of each bond using the current market prices. 8 D. Calculate the DURATION and MODIFIED DURATION of each bond. 9 10 11 Band A Band B 12 Setement Date 2/15/12 2/15/12 13 Maturity Dalt 215/32 2/15/12 14 Coupon Bale 5.00 7.50% 15 Price $890.00 51,040.00 16 Face Value $1,000.00 $1,000.00 17 Required Retur 4.00% 8.00% 18 Frequency 2 19 20 Intrinsic Value 51.13678 597972 21 Under Over Vaheed underved 22 Current Yield 5.62 7.21 23 Yield to Maurity 4.000 8.00% 24 Duration 13.35 25 Medified Duration 13.09 4.00 26 YM 27 Price 04 28 E. Constructa line chart showing the relationship between yield and price for two bends. 19 29 16 30 Place Charter 31 32 33 14 78 35 36 994 10% 1194 83 134 14% IS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts