Question: How do you calculate the answer to (a) Question 2 ChipCo designs and produces logic devices that are built into smart phones, tablet devices, personal

How do you calculate the answer to (a)

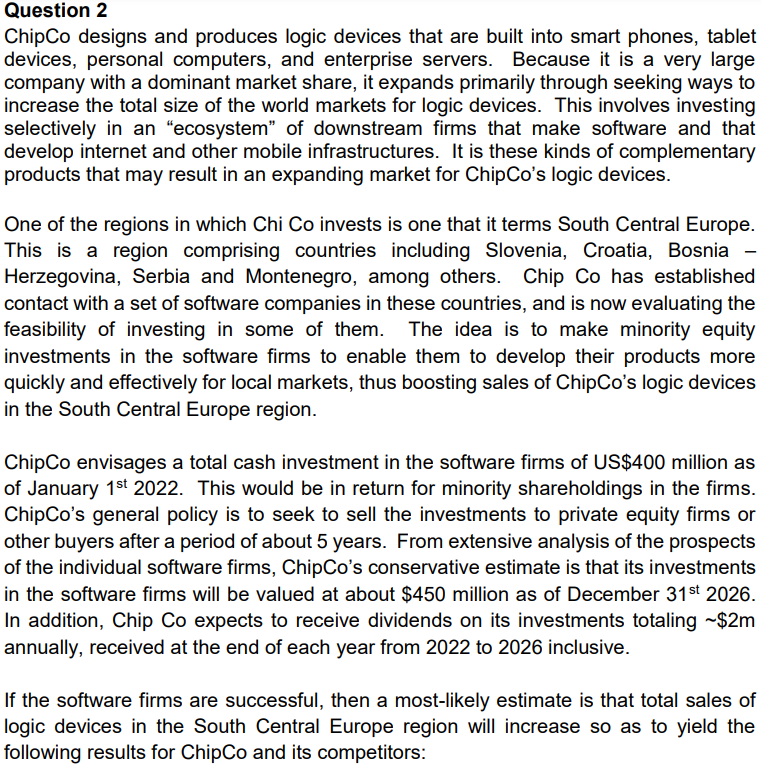

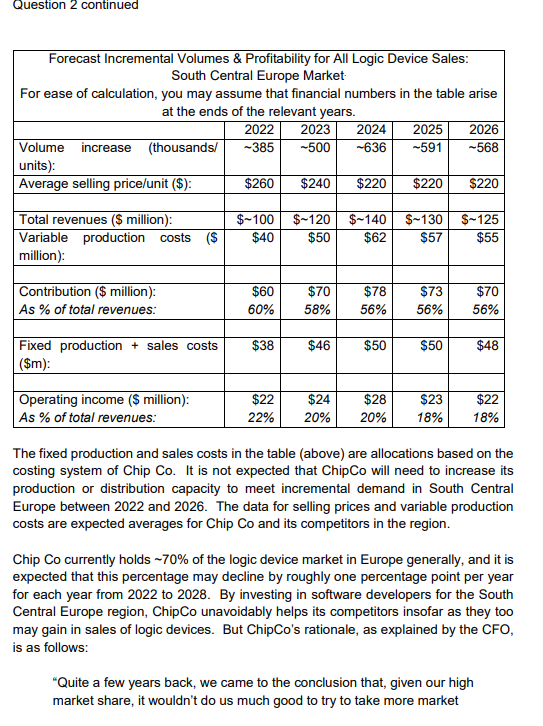

Question 2 ChipCo designs and produces logic devices that are built into smart phones, tablet devices, personal computers, and enterprise servers. Because it is a very large company with a dominant market share, it expands primarily through seeking ways to increase the total size of the world markets for logic devices. This involves investing selectively in an ecosystem" of downstream firms that make software and that develop internet and other mobile infrastructures. It is these kinds of complementary products that may result in an expanding market for ChipCo's logic devices. One of the regions in which Chi Co invests is one that it terms South Central Europe. This is a region comprising countries including Slovenia, Croatia, Bosnia - Herzegovina, Serbia and Montenegro, among others. Chip Co has established contact with a set of software companies in these countries, and is now evaluating the feasibility of investing in some of them. The idea is to make minority equity investments in the software firms to enable them to develop their products more quickly and effectively for local markets, thus boosting sales of ChipCo's logic devices in the South Central Europe region. ChipCo envisages a total cash investment in the software firms of US$400 million as of January 1st 2022. This would be in return for minority shareholdings in the firms. ChipCo's general policy is to seek to sell the investments to private equity firms or other buyers after a period of about 5 years. From extensive analysis of the prospects of the individual software firms, ChipCo's conservative estimate is that its investments in the software firms will be valued at about $450 million as of December 31st 2026. In addition, Chip Co expects to receive dividends on its investments totaling ~$2m annually, received at the end of each year from 2022 to 2026 inclusive. If the software firms are successful, then a most-likely estimate is that total sales of logic devices in the South Central Europe region will increase so as to yield the following results for ChipCo and its competitors: Question 2 continued Forecast Incremental Volumes & Profitability for All Logic Device Sales: South Central Europe Market For ease of calculation, you may assume that financial numbers in the table arise at the ends of the relevant years. 2022 2023 2024 2025 2026 Volume increase (thousands/ -385 -500 -636 -591 -568 units): Average selling price/unit ($): $260 $240 $220 $220 $220 Total revenues ($ million): $-125 $-100 $-120 $-140 $-130 $50 $62 $40 $57 $55 Variable production costs ($ million): Contribution ($ million): $60 $70 $78 $73 $70 As % of total revenues: 60% 58% 56% 56% 56% $38 $46 $50 $50 $48 Fixed production + sales costs ($m): $22 Operating income ($ million): As % of total revenues: $24 $28 $23 $22 20% 20% 18% 18% 22% The fixed production and sales costs in the table (above) are allocations based on the costing system of Chip Co. It is not expected that ChipCo will need to increase its production or distribution capacity to meet incremental demand in South Central Europe between 2022 and 2026. The data for selling prices and variable production costs are expected averages for Chip Co and its competitors in the region. Chip Co currently holds -70% of the logic device market in Europe generally, and it is expected that this percentage may decline by roughly one percentage point per year for each year from 2022 to 2028. By investing in software developers for the South Central Europe region, ChipCo unavoidably helps its competitors insofar as they too may gain in sales of logic devices. But ChipCo's rationale, as explained by the CFO, is as follows: "Quite a few years back, we came to the conclusion that, given our high market share, it wouldn't do us much good to try to take more market Question 2 continued share from our competitors. Instead, we have found it better to invest to expand the market overall, on the assumption that we can compete to take a sizeable share of that increase. Of course, our competitors may gain from our investments to strengthen the overall software ecosystem, but that's a price we may pay so long as the net benefit to us is sufficient". The cost of capital rate used by Chip Co is 10% per annum and the relevant discount rates are as follows: Discount Factor at 10% per annum Years 10% 1 0.9091 2 0.8264 3 0.7513 4 0.6830 5 0.6209 REQUIRED: a) Compute the Net Present Value of the estimated direct returns from the minority equity investments. Your computations should show clearly how you arrive at your answer. (7 marks) And: b) Compute the Net Present Value of the combined direct returns from the minority equity investments and the indirect returns of making the investments in software firms. Your computations should show clearly how you arrive at your answer. (8 marks) And: Question 2 ChipCo designs and produces logic devices that are built into smart phones, tablet devices, personal computers, and enterprise servers. Because it is a very large company with a dominant market share, it expands primarily through seeking ways to increase the total size of the world markets for logic devices. This involves investing selectively in an ecosystem" of downstream firms that make software and that develop internet and other mobile infrastructures. It is these kinds of complementary products that may result in an expanding market for ChipCo's logic devices. One of the regions in which Chi Co invests is one that it terms South Central Europe. This is a region comprising countries including Slovenia, Croatia, Bosnia - Herzegovina, Serbia and Montenegro, among others. Chip Co has established contact with a set of software companies in these countries, and is now evaluating the feasibility of investing in some of them. The idea is to make minority equity investments in the software firms to enable them to develop their products more quickly and effectively for local markets, thus boosting sales of ChipCo's logic devices in the South Central Europe region. ChipCo envisages a total cash investment in the software firms of US$400 million as of January 1st 2022. This would be in return for minority shareholdings in the firms. ChipCo's general policy is to seek to sell the investments to private equity firms or other buyers after a period of about 5 years. From extensive analysis of the prospects of the individual software firms, ChipCo's conservative estimate is that its investments in the software firms will be valued at about $450 million as of December 31st 2026. In addition, Chip Co expects to receive dividends on its investments totaling ~$2m annually, received at the end of each year from 2022 to 2026 inclusive. If the software firms are successful, then a most-likely estimate is that total sales of logic devices in the South Central Europe region will increase so as to yield the following results for ChipCo and its competitors: Question 2 continued Forecast Incremental Volumes & Profitability for All Logic Device Sales: South Central Europe Market For ease of calculation, you may assume that financial numbers in the table arise at the ends of the relevant years. 2022 2023 2024 2025 2026 Volume increase (thousands/ -385 -500 -636 -591 -568 units): Average selling price/unit ($): $260 $240 $220 $220 $220 Total revenues ($ million): $-125 $-100 $-120 $-140 $-130 $50 $62 $40 $57 $55 Variable production costs ($ million): Contribution ($ million): $60 $70 $78 $73 $70 As % of total revenues: 60% 58% 56% 56% 56% $38 $46 $50 $50 $48 Fixed production + sales costs ($m): $22 Operating income ($ million): As % of total revenues: $24 $28 $23 $22 20% 20% 18% 18% 22% The fixed production and sales costs in the table (above) are allocations based on the costing system of Chip Co. It is not expected that ChipCo will need to increase its production or distribution capacity to meet incremental demand in South Central Europe between 2022 and 2026. The data for selling prices and variable production costs are expected averages for Chip Co and its competitors in the region. Chip Co currently holds -70% of the logic device market in Europe generally, and it is expected that this percentage may decline by roughly one percentage point per year for each year from 2022 to 2028. By investing in software developers for the South Central Europe region, ChipCo unavoidably helps its competitors insofar as they too may gain in sales of logic devices. But ChipCo's rationale, as explained by the CFO, is as follows: "Quite a few years back, we came to the conclusion that, given our high market share, it wouldn't do us much good to try to take more market Question 2 continued share from our competitors. Instead, we have found it better to invest to expand the market overall, on the assumption that we can compete to take a sizeable share of that increase. Of course, our competitors may gain from our investments to strengthen the overall software ecosystem, but that's a price we may pay so long as the net benefit to us is sufficient". The cost of capital rate used by Chip Co is 10% per annum and the relevant discount rates are as follows: Discount Factor at 10% per annum Years 10% 1 0.9091 2 0.8264 3 0.7513 4 0.6830 5 0.6209 REQUIRED: a) Compute the Net Present Value of the estimated direct returns from the minority equity investments. Your computations should show clearly how you arrive at your answer. (7 marks) And: b) Compute the Net Present Value of the combined direct returns from the minority equity investments and the indirect returns of making the investments in software firms. Your computations should show clearly how you arrive at your answer. (8 marks) And

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts