Question: how do you calculate the setup cost for each supplier? Sue Jones sat at ber desk reflecting on a pricing problem. Sue was a graduate

how do you calculate the setup cost for each supplier?

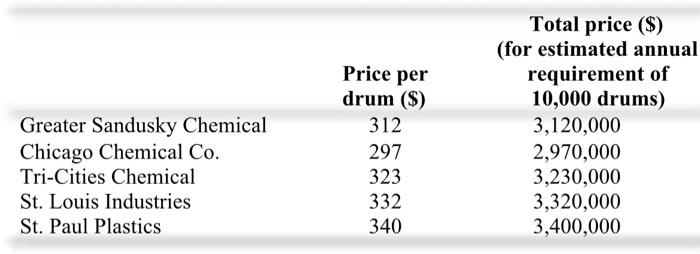

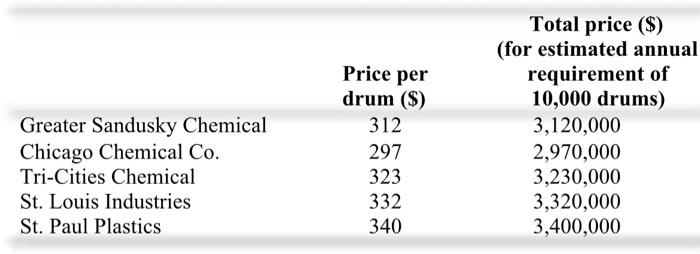

Sue Jones sat at ber desk reflecting on a pricing problem. Sue was a graduate of State University, where she majored in materials management. Since joining the small manufacturing firm of Prestige Plastics in Des Moines, she had been promoted from assistant supply manager to supply manager. She was responsible for buying the chemicals used in producing the firm"s plastic products. Sue was really perplexed by a particular procurcment involving the purchase of X-pane, a chemical that was formulated specifically for Presige Plastics. Thirty-one days ago, she forwarded a request for bids to six suppliers for Prestige's estimated annual requirement of 10,000 drums of X-pane. Yesterday moming. Sue opened the five bids that had been received. The bids, F.O.B. Des Moines, were as follows: The Chicagso Chemical Company was low bidder for the fifth straight year. On the face of it, a decision to award the annual requirements contract to Chicago Chemical looked obvious. The day after the bid opening, the sales engineer from Greater Sandusky Chemical threw Sue a ringer. He said that no one would ever be able to beat Chicago Chemical"s price. His firm estimated that setup costs associated with producing X-pane would be approximately $750,000. He went on to say that due to the uncertainties of follow-on ordern, his firm would have to amortize this cost over the one-year period of the contract to preclude a loss. Sue checked with the other unsuccessful bidders. They said substantially the same thing: $700,000 to $850,000 in setup costs were included in their prices. Next, Sue looked at the history of past parchases of X-panc. She saw that on the initial procurement five years ago, Chicago Chemical's bid was $202 per barrel, \$3 lower than the second lowest price. Since that time, bid prices had increased, reflecting cost growth in the materials required to produce X-pane. Each year, Chicago Chemical's prices were $3 to $15 per dram lower than those of the unsuccessful competitors. Sue knew from her supply management course at State University that when five prerequisites were satisfied, under most conditions, competitive bidding normally resulted in the lowest price. She also knew that it was important to maintain the integrity of the competitive bidding process. But Sue felt a strong sense of unessiness. Something did not seem right, Sue Jones sat at ber desk reflecting on a pricing problem. Sue was a graduate of State University, where she majored in materials management. Since joining the small manufacturing firm of Prestige Plastics in Des Moines, she had been promoted from assistant supply manager to supply manager. She was responsible for buying the chemicals used in producing the firm"s plastic products. Sue was really perplexed by a particular procurcment involving the purchase of X-pane, a chemical that was formulated specifically for Presige Plastics. Thirty-one days ago, she forwarded a request for bids to six suppliers for Prestige's estimated annual requirement of 10,000 drums of X-pane. Yesterday moming. Sue opened the five bids that had been received. The bids, F.O.B. Des Moines, were as follows: The Chicagso Chemical Company was low bidder for the fifth straight year. On the face of it, a decision to award the annual requirements contract to Chicago Chemical looked obvious. The day after the bid opening, the sales engineer from Greater Sandusky Chemical threw Sue a ringer. He said that no one would ever be able to beat Chicago Chemical"s price. His firm estimated that setup costs associated with producing X-pane would be approximately $750,000. He went on to say that due to the uncertainties of follow-on ordern, his firm would have to amortize this cost over the one-year period of the contract to preclude a loss. Sue checked with the other unsuccessful bidders. They said substantially the same thing: $700,000 to $850,000 in setup costs were included in their prices. Next, Sue looked at the history of past parchases of X-panc. She saw that on the initial procurement five years ago, Chicago Chemical's bid was $202 per barrel, \$3 lower than the second lowest price. Since that time, bid prices had increased, reflecting cost growth in the materials required to produce X-pane. Each year, Chicago Chemical's prices were $3 to $15 per dram lower than those of the unsuccessful competitors. Sue knew from her supply management course at State University that when five prerequisites were satisfied, under most conditions, competitive bidding normally resulted in the lowest price. She also knew that it was important to maintain the integrity of the competitive bidding process. But Sue felt a strong sense of unessiness. Something did not seem right