Question: how do you calculate the YTM ( yield to maturity) full working out You have been tasked with the responsibility of calculating the WACC for

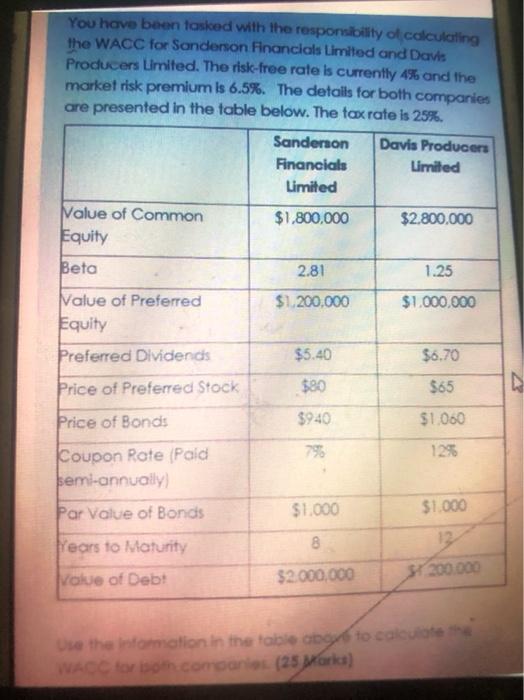

You have been tasked with the responsibility of calculating the WACC for Sonderson Financials Limited and Davis Producers Limited. The risk-free rate is currently 4% and the market risk premium is 6.5%. The details for both companies are presented in the table below. The tax rate is 25%. Sanderson Davis Producers Financials Limited Limited Value of Common $1,800,000 $2.800.000 Equity Beta 2.81 1.25 Value of Preferred $1.200.000 $1.000.000 Equity Preferred Dividends $5.40 $6.70 Price of Preferred Stock $80 $65 Price of Bonds $940 $1.060 1295 Coupon Rate (Paid bemi-annually Par Value of Bonds $1.000 $1.000 8 Years to Maturity Value of Debt $2.000.000 Use the information in the table abg to calculate WACC for both companiol (25 arka)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts