Question: How do you create a cash flow statement with the information provided? The numbers will not add up but that is fine I am mostly

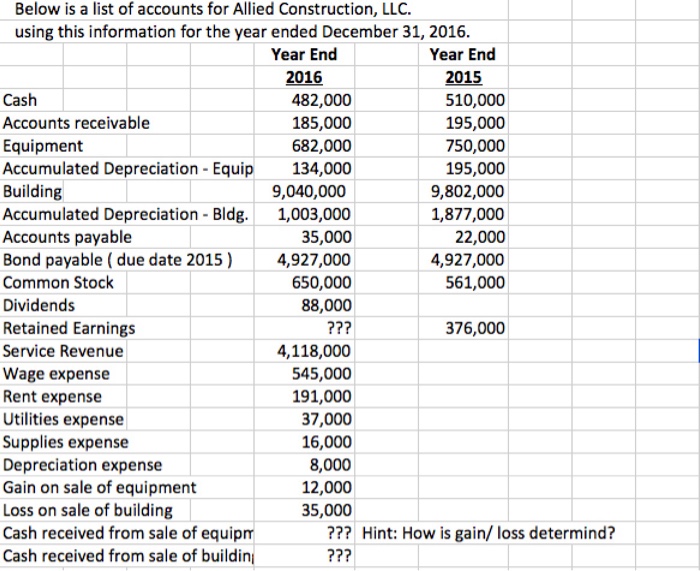

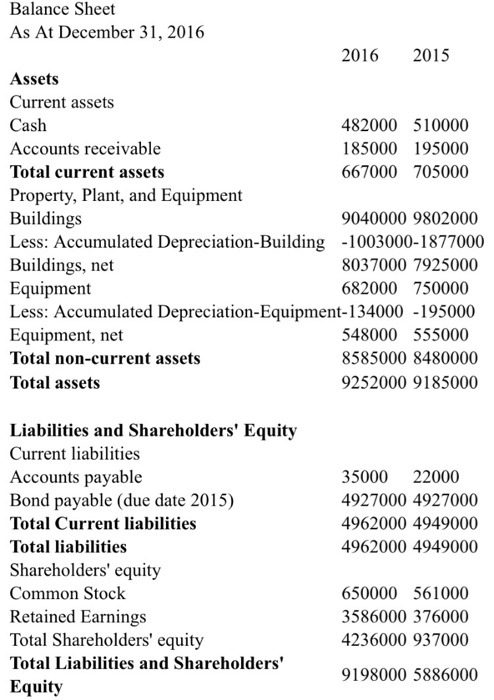

Below is a list of accounts for Allied Construction, LLC. using this information for the year ended December 31, 2016. Year End Year End 2016 2015 Cash 510,000 482,000 185,000 195,000 Accounts receivable 682,000 750,000 Equipment Accumulated Depreciation Equip 134,000 195,000 Building 9,040,000 9,802,000 Accumulated Depreciation Bldg. 1,003,000 1,877,000 Accounts payable 35,000 22,000 Bond payable (due date 2015 4,927,000 4,927,000 Common Stock 561,000 650,000 Dividends 88,000 Retained Earnings 376,000 Service Revenue 4,118,000 Wage expense 545,000 191,000 Rent expense Utilities expense 37,000 16,000 Supplies expense 8,000 Depreciation expense Gain on sale of equipment 12,000 Loss on sale of building 35,000 Hint: How is gain/ loss determind? Cash received from sale of equipm Cash received from sale of buildini

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts