Question: How do you do it on a financial calculator if needed Valuation You own 100% of the 1,000,000 shares issued of a start up you

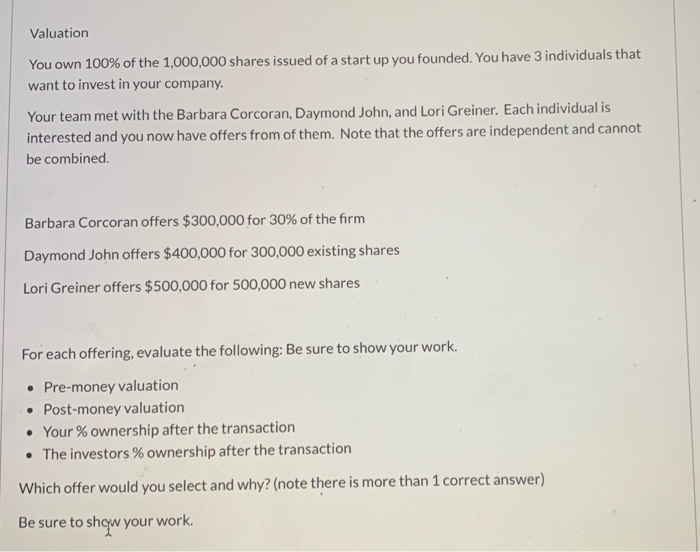

Valuation You own 100% of the 1,000,000 shares issued of a start up you founded. You have 3 individuals that want to invest in your company. Your team met with the Barbara Corcoran, Daymond John, and Lori Greiner. Each individual is interested and you now have offers from of them. Note that the offers are independent and cannot be combined. Barbara Corcoran offers $300,000 for 30% of the form Daymond John offers $400,000 for 300,000 existing shares Lori Greiner offers $500,000 for 500,000 new shares For each offering, evaluate the following: Be sure to show your work. Pre-money valuation Post-money valuation Your % ownership after the transaction The investors % ownership after the transaction Which offer would you select and why? (note there is more than 1 correct answer) Be sure to show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts