Question: How do you do part b? Blossom Corp issued 10-year bonds four years ago with a coupon rate of 10.390 percent. At the time of

How do you do part b?

How do you do part b?

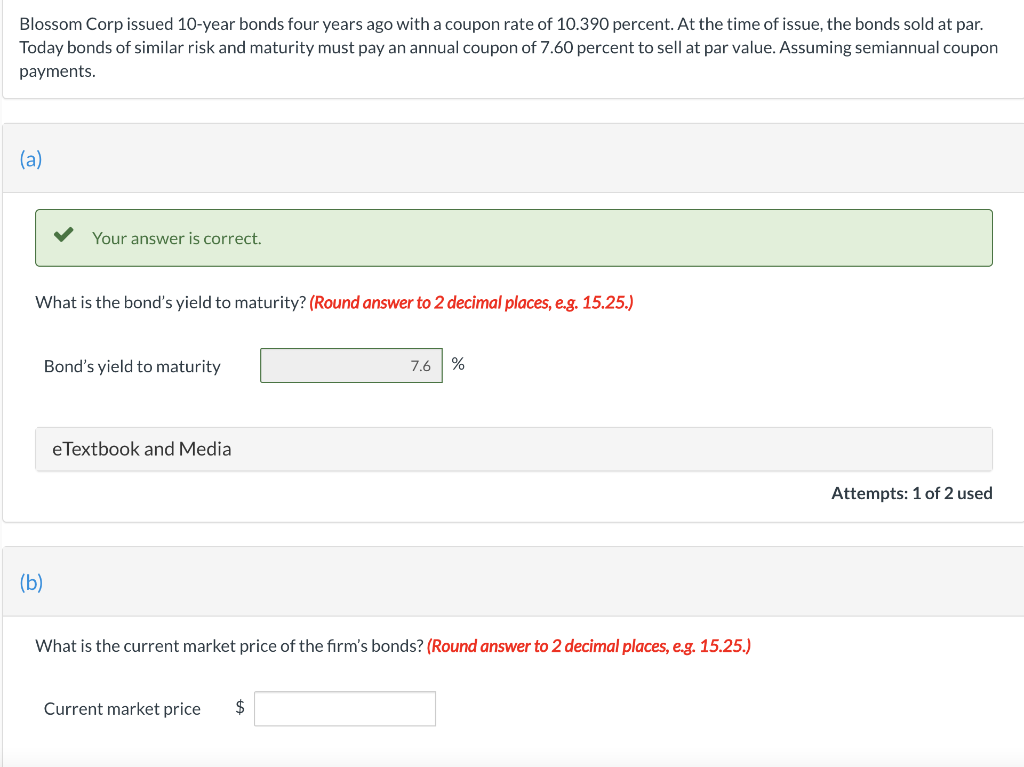

Blossom Corp issued 10-year bonds four years ago with a coupon rate of 10.390 percent. At the time of issue, the bonds sold at par. Today bonds of similar risk and maturity must pay an annual coupon of 7.60 percent to sell at par value. Assuming semiannual coupon payments. (a) Your answer is correct. What is the bond's yield to maturity? (Round answer to 2 decimal places, e.g. 15.25.) Bond's yield to maturity 7.6 % e Textbook and Media Attempts: 1 of 2 used (b) What is the current market price of the firm's bonds? (Round answer to 2 decimal places, e.g. 15.25.) Current market price $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts