Question: How do you do question 21 Actual Returns Returns 2009 10 12 2010 11 8 2011 -8-11 2012 -6 14 2013 28 7 21. CAPM

How do you do question 21

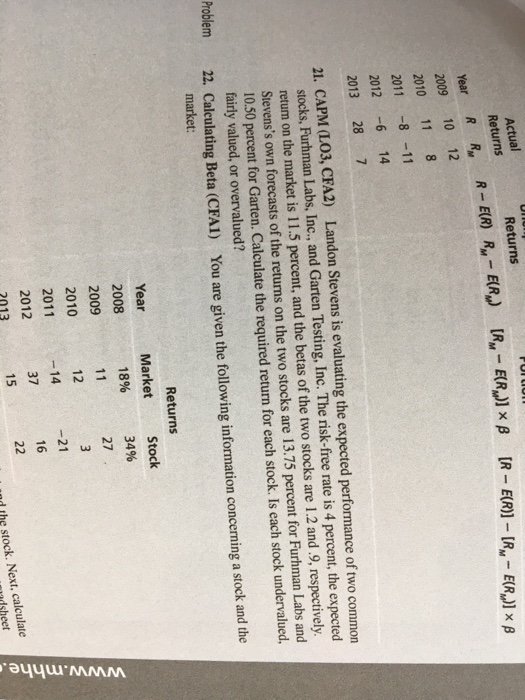

How do you do question 21 Actual Returns Returns 2009 10 12 2010 11 8 2011 -8-11 2012 -6 14 2013 28 7 21. CAPM (L03, CFA2) Landon Stevens is evaluating the expected performance of two common stocks, Furhman Labs, Inc., and Garten Testing, Inc. The risk-free rate is 4 percent, the expected retum on the market is 11.5 percent, and the betas of the two stocks are 1.2 and.9, respectively Stevens's own forecasts of the returns on the two stocks are 13.75 percent for Furhman Labs and 10.50 percent for Garten. Calculate the required return for each stock. Is each stock undervalued. fairly valued, or overvalued? Problem 22. Caleulating Beta (CFAI) You are given the followi ng information concerning a stock and the Returns YearMarket Stock 2008 2009 2010 2011-14 21 2012 013 18% 34% 27 12 37 16 15 d the stock. Next, calculate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts