Question: How do you do this? If Julius has a 22 percent tax rate and a 11 percent after-tax rate of return, $35,500 of income in

How do you do this?

How do you do this?

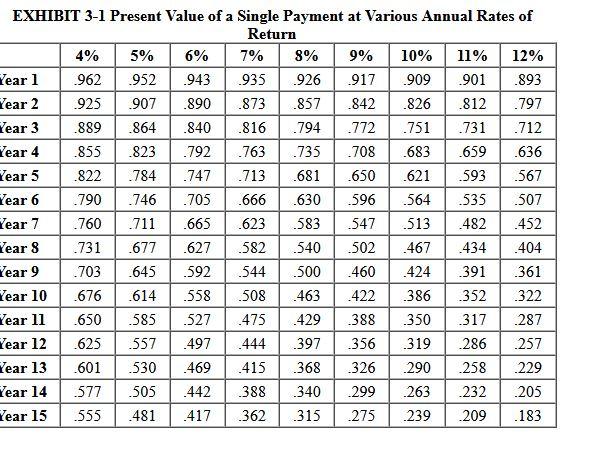

If Julius has a 22 percent tax rate and a 11 percent after-tax rate of return, $35,500 of income in three years will cost him how much tax in today's dollars? Use Exhibit 3.1. (Round discount factor(s) to three decimal places.) 8% EXHIBIT 3-1 Present Value of a Single Payment at Various Annual Rates of Return 4% 5% 6% 7% 9% 10% 11% 12% Year 1 962 952 943 935 926 917 909 901 .893 Year 2 925 907 .890 .873 .857 .842 .826 .812 -797 Year 3 .889 .864 .840 .816 .794 .772 .751 .731 .712 Year 4 .855 .823 .792 .763 .735 .708 .683 .659 .636 Year 5 .822 .784 .747 .713 .681 .650 .621 593 .567 Year 6 .790 .746 .705 .666 .630 596 564 535 -507 Year 7 .760 1711 .665 .623 583 547 .513 .482 -452 Year 8 -731 .677 .627 582 540 502 467 434 404 Year 9 -703 .645 .592 544 .500 460 424 391 361 Year 10 .676 .614 .558 508 463 422 386 352 322 Year 11 .650 .585 527 475 429 388 350 317 .287 Year 12 .625 557 .497 444 397 356 319 286 .257 Year 13 .601 .530 .469 415 368 326 .290 .258 .229 Year 14 577 .505 442 388 340 .299 .263 .232 .205 Year 15 555 481 417 362 315 275 .239 .209 .183

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts