Question: How do you do this problem? Use the following information to answer Problem.: Beagle Beauties engages in the development, manufacture, and sale of a line

How do you do this problem?

How do you do this problem?

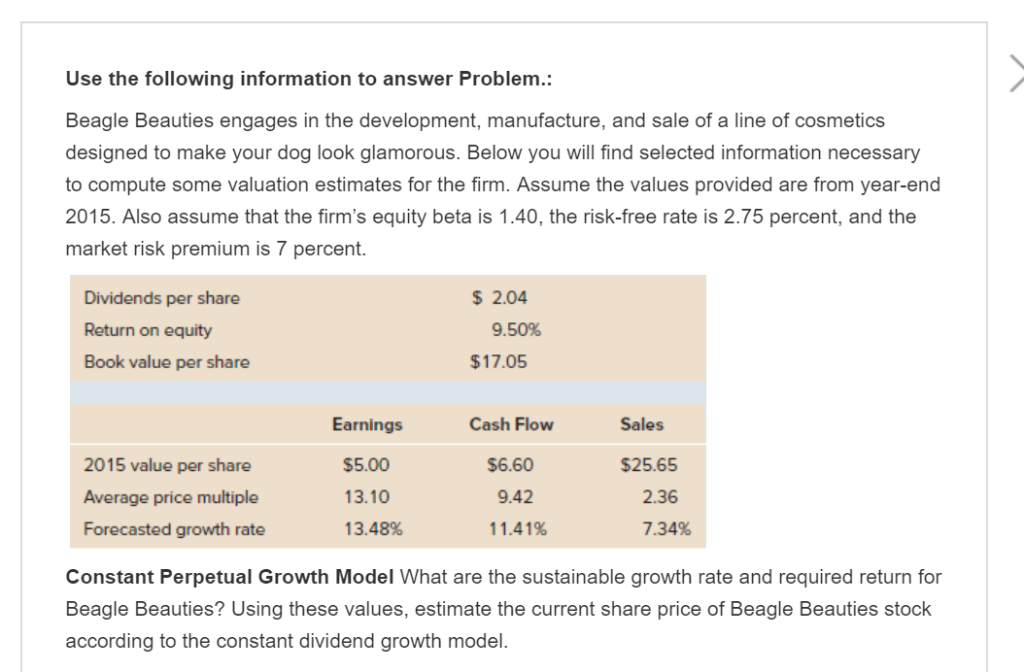

Use the following information to answer Problem.: Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2015. Also assume that the firm's equity beta is 1.40, the risk-free rate is 2.75 percent, and the market risk premium is 7 percent. $2.04 Dividends per share Return on equity Book value per share 9.50% $17.05 Earnings $5.00 13.10 13.48% Cash Flow $6.60 9.42 11.41% Sales $25.65 2015 value per share Average price multiple Forecasted growth rate 2.36 7.34% Constant Perpetual Growth Model What are the sustainable growth rate and required return for Beagle Beauties? Using these values, estimate the current share price of Beagle Beauties stock according to the constant dividend growth model Use the following information to answer Problem.: Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2015. Also assume that the firm's equity beta is 1.40, the risk-free rate is 2.75 percent, and the market risk premium is 7 percent. $2.04 Dividends per share Return on equity Book value per share 9.50% $17.05 Earnings $5.00 13.10 13.48% Cash Flow $6.60 9.42 11.41% Sales $25.65 2015 value per share Average price multiple Forecasted growth rate 2.36 7.34% Constant Perpetual Growth Model What are the sustainable growth rate and required return for Beagle Beauties? Using these values, estimate the current share price of Beagle Beauties stock according to the constant dividend growth model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts