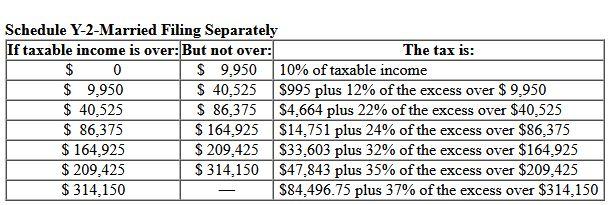

Question: How do you do this? Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10%

How do you do this?

How do you do this?

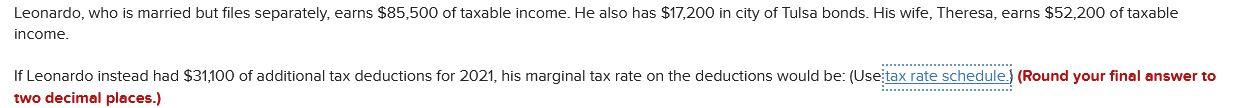

Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $9.950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $ 164,925 $14.751 plus 24% of the excess over $86,375 $ 164,925 $ 209,425 $33,603 plus 32% of the excess over $164.925 $ 209,425 $ 314,150 $47.843 plus 35% of the excess over $209,425 $ 314,150 $84,496.75 plus 37% of the excess over $314,150 Leonardo, who is married but files separately, earns $85,500 of taxable income. He also has $17,200 in city of Tulsa bonds. His wife, Theresa, earns $52,200 of taxable income. If Leonardo instead had $31,100 of additional tax deductions for 2021, his marginal tax rate on the deductions would be: (Use tax rate schedule.) (Round your final answer to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts