Question: how do you draw the graph if it has one year bonds over the next 4 years with the expected interest rates being 4%,5%,6%,7% Homework:

how do you draw the graph if it has one year bonds over the next 4 years with the expected interest rates being 4%,5%,6%,7%

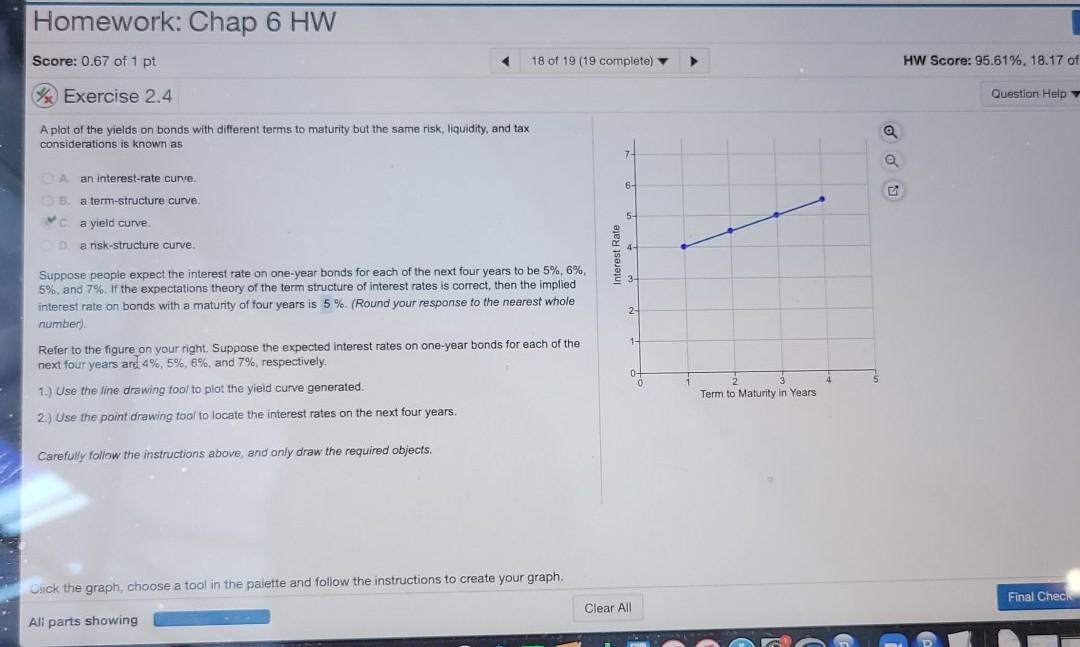

Homework: Chap 6 HW Score: 0.67 of 1 pt 1 18 of 19 (19 complete) HW Score: 95.61%, 18.17 of Exercise 2.4 Question Help A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as a an interest-rate curve. 6- a term-structure curve 5 a yield curve Da risk-structure curve. nterest Suppose people expect the interest rate on one-year bonds for each of the next four years to be 5%, 6% 5%, and 7%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four years is 5%. (Round your response to the nearest whole number) 2. 1 Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years ar 4%, 5%, 6%, and 7%, respectively. 0 Term to Maturity in Years 1.) Use the line drawing tool to plot the yield curve generated. 2.) Use the point drawing tool to locate the interest rates on the next four years. Carefully follow the instructions above, and only draw the required objects. Click the graph, choose a tool in the palette and follow the instructions to create your graph. Final Chec Clear All All parts showing Homework: Chap 6 HW Score: 0.67 of 1 pt 1 18 of 19 (19 complete) HW Score: 95.61%, 18.17 of Exercise 2.4 Question Help A plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as a an interest-rate curve. 6- a term-structure curve 5 a yield curve Da risk-structure curve. nterest Suppose people expect the interest rate on one-year bonds for each of the next four years to be 5%, 6% 5%, and 7%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four years is 5%. (Round your response to the nearest whole number) 2. 1 Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years ar 4%, 5%, 6%, and 7%, respectively. 0 Term to Maturity in Years 1.) Use the line drawing tool to plot the yield curve generated. 2.) Use the point drawing tool to locate the interest rates on the next four years. Carefully follow the instructions above, and only draw the required objects. Click the graph, choose a tool in the palette and follow the instructions to create your graph. Final Chec Clear All All parts showing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts