Question: How do you enter the journal entry for #4 part A, please explain how to get the interest expense and interest payable. Interest Payable for

How do you enter the journal entry for #4 part A, please explain how to get the interest expense and interest payable. Interest Payable for 2021 was 5,208, Notes Payable for 2021 was 125,000

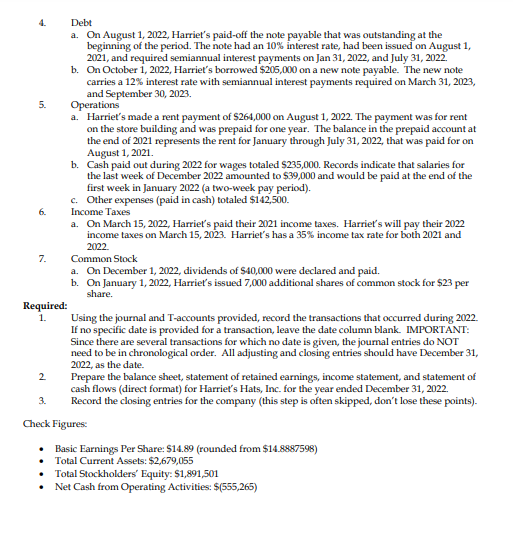

4. Debt a. On August 1, 2022, Harriet's paid-off the note payable that was outstanding at the beginning of the period. The note had an 10% interest rate, had been issued on August 1 , 2021 , and required semiannual interest payments on Jan 31,2022 , and July 31,2022 . b. On October 1,2022 , Harriet's borrowed $205,000 on a new note payable. The new note carries a 12% interest rate with semiannual interest payments required on March 31,2023 , and September 30, 2023. 5. Operations a. Harriet's made a rent payment of $264,000 on August 1,2022 . The payment was for rent on the store building and was prepaid for one year. The balance in the prepaid account at the end of 2021 represents the rent for January through July 31, 2022, that was paid for on August 1, 2021. b. Cash paid out during 2022 for wages totaled $235,000. Records indicate that salaries for the last week of December 2022 amounted to $39,000 and would be paid at the end of the first week in January 2022 (a two-week pay period). c. Other expenses (paid in cash) totaled $142,500. 6. Income Taxes a. On March 15,2022 , Harriet's paid their 2021 income taxes. Harriet's will pay their 2022 income taxes on March 15, 2023. Harriet's has a 35% income tax rate for both 2021 and 2022. 7. Common Stock a. On December 1,2022 , dividends of $40,000 were declared and paid. b. On January 1, 2022, Harriet's issued 7,000 additional shares of common stock for $23 per share. Required: 1. Using the journal and T-accounts provided, record the transactions that occurred during 2022. If no specific date is provided for a transaction, leave the date column blank. IMPORTANT: Since there are several transactions for which no date is given, the joumal entries do NOT need to be in chronological order. All adjusting and closing entries should have December 31 , 2022 , as the date. 2. Prepare the balance sheet, statement of retained earnings, income statement, and statement of cash flows (direct format) for Harriet's Hats, Inc. for the year ended December 31,2022 . Record the closing entries for the company (this step is often skipped, don't lose these points). 3. Recor - Basic Earnings Per Share: $14.89 (rounded from $14.8887598 ) - Total Current Assets: \$2,679,055 - Total Stockholders' Equity: \$1,891,501 - Net Cash from Operating Activities: $(555,265)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts