Question: How do you find Diluted EPS in this problem? Use the following information to answer questions 14 and 15 Instructions for problems 14 and 15:

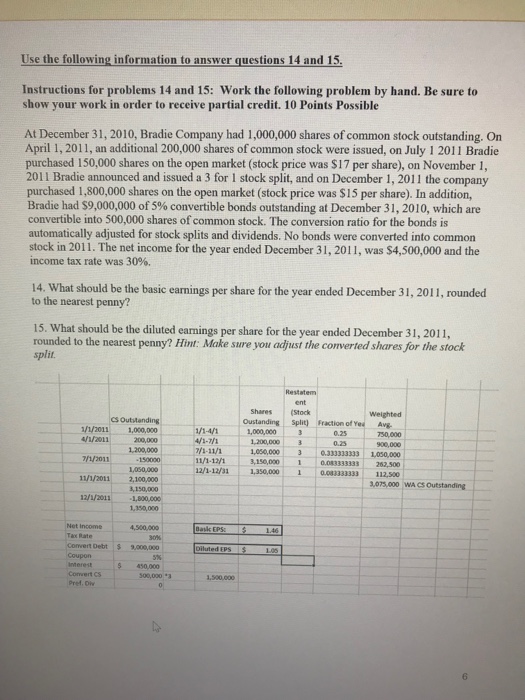

Use the following information to answer questions 14 and 15 Instructions for problems 14 and 15: Work the following problem by hand. Be sure to show your work in order to receive partial credit. 10 Points Possible At December 31, 2010, Bradie Company had 1,000,000 shares of common stock outstanding. On April 1,2011, an additional 200,000 shares of common stock were issued, on July 1 2011 Bradie purchased 150,000 shares on the open market (stock price was $17 per share), on November 1, 2011 Bradie announced and issued a 3 for 1 stock split, and on December 1, 2011 the company purchased 1,800,000 shares on the open market (stock price was $15 per share). In addition, Bradie had S9,000,000 of 5% convertible bonds outstanding at December 31, 2010, which are convertible into 500,000 shares of common stock. The conversion ratio for the bonds is automatically adjusted for stock splits and dividends. No bonds were converted into common stock in 2011. The net income for the year ended December 31, 2011, was $4,500,000 and the income tax rate was 30%. 14. What should be the basic earnings per share for the year ended December 31, 2011, rounded to the nearest penny? 15. What should be the diluted earnings per share for the year ended December 31, 2011, rounded to the nearest penny? Hint: Make sure you adjust the converted shares for the stock split tatem ent Shares (Stock Weighted CS Outstanding Oustanding Split) Fraction of Yed Avg. 1/1/2011 1,000,0001/1-4/1 i 1,000,000 750,000 200,000 778 1.2950023/850 ,050,0003 0.333333333 1,050,000 ,150,000 1 0083333333 262,500 12/1-12/31 1,350,000 1 0.083333333 112,500 ,075,000 2//2011 -150000111-12/3 050,000 11/1/2o11 2,100,000 3,150,000 121/2011 1,800,000 1,350,000 WA CS Outstanding Net Income 4,300,000 Convert Debt $ 3,000,000 $ 450,000 coupon , - Convert Cs Pref. Div 500,000 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts