Question: how do you find out this answer. Show working! UN Green Forest Aviation has issued bonds, common stock, and preferred stock. The YTM for the

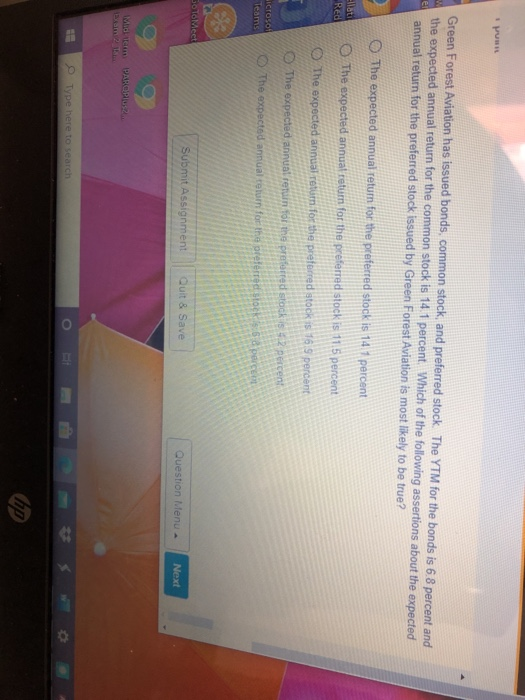

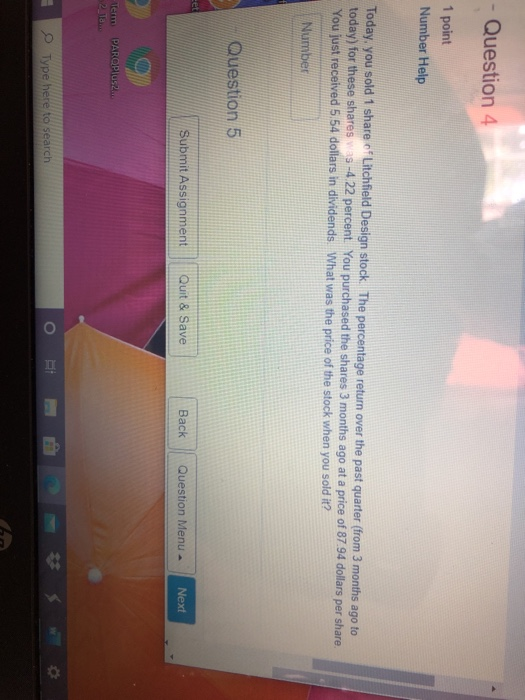

UN Green Forest Aviation has issued bonds, common stock, and preferred stock. The YTM for the bonds is 6.8 percent and the expected annual return for the common stock is 14.1 percent. Which of the following assertions about the expected annual return for the preferred stock issued by Green Forest Aviation is most likely to be true? el The expected annual return for the preferred stock is 14.1 percent The expected annual return for the preferred stock is 11.5 percent Red The expected annual return for the preferred stock is 16.9 percent The expected annual return for the preferred stack is 42 percent ICTOS Teams The expected annual turn for the preferred stock is a perc SoToMeet Submit Assignment Quit & Save Question Menu Next Mid PAR Plus Type here to search o - Question 4 1 point Number Help Today, you sold 1 share of Litchfield Design stock. The percentage return over the past quarter (from 3 months ago to today) for these shares was -4 22 percent. You purchased the shares 3 months ago at a price of 87.94 dollars per share You just received 5.54 dollars in dividends. What was the price of the stock when you sold it? Number Question 5 Submit Assignment Quit & Save Back Question Menu Next Term PAROP o Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts