Question: how do you find the Assets utilization ratios, long-term solvency ratios, profitability ratios measures SMOLIRA GOLF CORP 2021 Income statement Sales Cost of goods sold

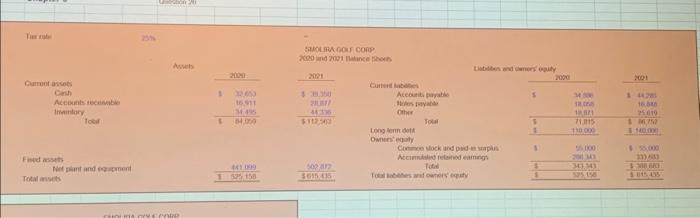

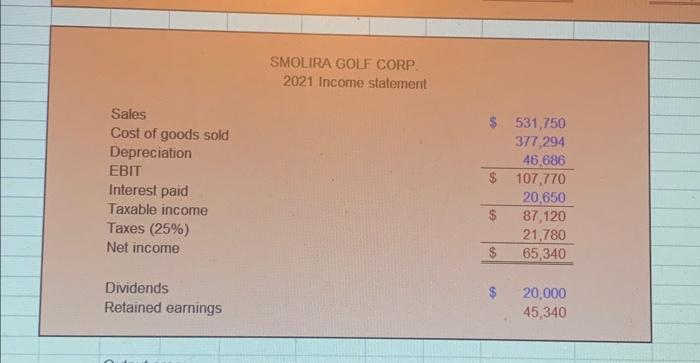

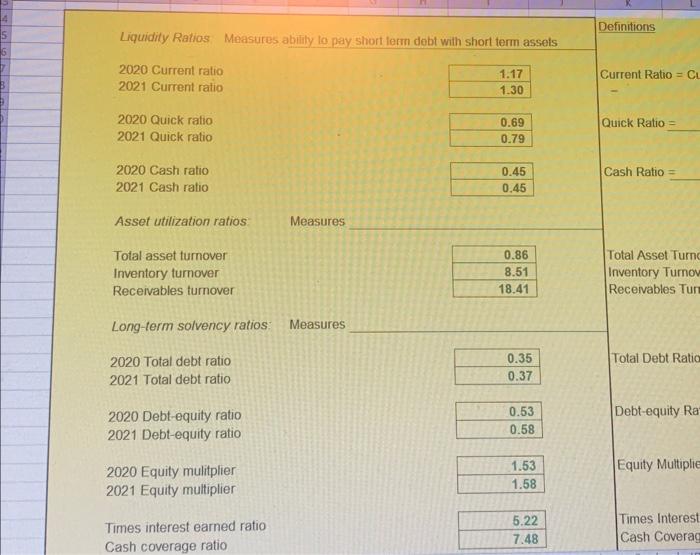

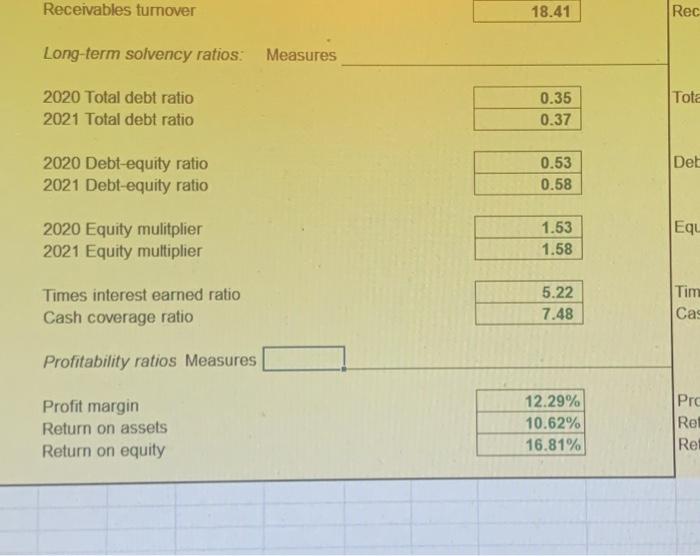

SMOLIRA GOLF CORP 2021 Income statement Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes (25\%) Net income Dividends Retained earnings \$ 531,750 377,294 \begin{tabular}{rr} & 46,686 \\ \hline$107,770 \\ & 20,650 \\ \hline$ & 87,120 \\ & 21,780 \\ \hline$65,340 \\ \hline \end{tabular} $20,000 Liquidity Ratios Measures ability lo pay short lerm dobt with short term assets Definitions 2020 Current ratio 2021 Current ratio 2020 Quick ratio 2021 Quick ratio 2020 Cash ratio 2021 Cash ratio Asset utilization ratios: Total asset turnover Inventory turnover Receivables turnover Long-term solvency ratios: 2020 Total debt ratio 2021 Total debt ratio 2020 Debt-equity ratio 2021 Debt-equity ratio 2020 Equity mulitplier 2021 Equity multiplier Times interest earned ratio Cash coverage ratio \begin{tabular}{|l|} \hline 1.17 \\ \hline 1.30 \\ \hline \end{tabular} \begin{tabular}{|l|} \hline 0.69 \\ \hline 0.79 \\ \hline \end{tabular} \begin{tabular}{|l|} \hline 0.45 \\ \hline 0.45 \\ \hline \end{tabular} Measures Current Ratio =C Quick Ratio = \begin{tabular}{|r|} \hline 0.86 \\ \hline 8.51 \\ \hline 18.41 \\ \hline \end{tabular} Measures Cash Ratio = \begin{tabular}{|r|} \hline 0.53 \\ \hline 0.58 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 1.53 \\ \hline 1.58 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 5.22 \\ \hline 7.48 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 5.22 \\ \hline 7.48 \\ \hline \end{tabular} Total Debt Ratic Total Asset Turn Inventory Turno Receivables Tun Debt-equity Ra Equity Multiplie Times Interest Cash Coverag Receivables turnover 18.41 Long-term solvency ratios: Measures 2020 Total debt ratio 2021 Total debt ratio \begin{tabular}{|l|} \hline 0.35 \\ \hline 0.37 \\ \hline \end{tabular} 2020 Debt-equity ratio 2021 Debt-equity ratio \begin{tabular}{|l|} \hline 0.53 \\ \hline 0.58 \\ \hline \end{tabular} 2020 Equity mulitplier 2021 Equity multiplier \begin{tabular}{|r|} \hline 1.53 \\ \hline 1.58 \\ \hline \end{tabular} Times interest earned ratio Cash coverage ratio \begin{tabular}{|r|} \hline 5.22 \\ \hline 7.48 \\ \hline \end{tabular} Profitability ratios Measures Profit margin Return on assets Return on equity \begin{tabular}{|r|} \hline 12.29% \\ \hline 10.62% \\ \hline 16.81% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

To find the financial ratios for Smolira Golf Corp for 2021 we consider three main categories asset ... View full answer

Get step-by-step solutions from verified subject matter experts