Question: How do you format a production cost report using the weighted-average method and using the FIFO method (the beginning direct materials costs as of June

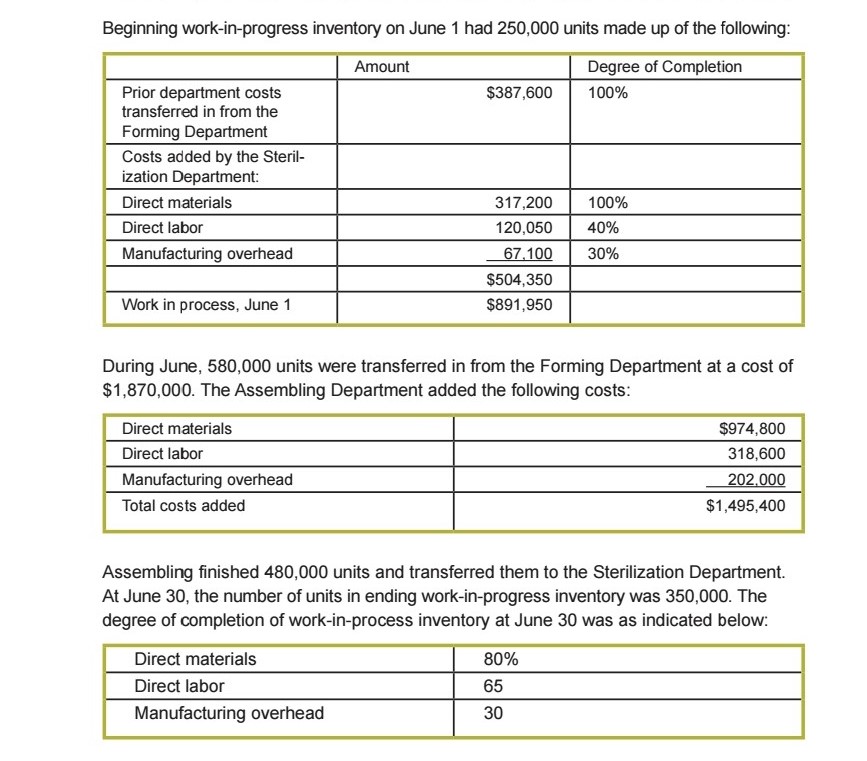

Beginning work-in-progress inventory on June 1 had 250,000 units made up of the following: Prior department costs transferred in from the Forming Department Costs added by the Steril- ization Department: Direct materials Direct labor Manufacturing overhead Work in process, June 1 Amount Degree of Completion $387,600 100% 317,200 100% 120,050 40% 67,100 30% $504,350 $891,950 During June, 580,000 units were transferred in from the Forming Department at a cost of $1,870,000. The Assembling Department added the following costs: Direct materials Direct labor Manufacturing overhead Total costs added $974,800 318,600 202,000 $1,495,400 Assembling finished 480,000 units and transferred them to the Sterilization Department. At June 30, the number of units in ending work-in-progress inventory was 350,000. The degree of completion of work-in-process inventory at June 30 was as indicated below: Direct materials Direct labor Manufacturing overhead 80% 65 30

Step by Step Solution

There are 3 Steps involved in it

Analyzing Production Costs and Equivalent Units Understanding the Data We have data on units in proc... View full answer

Get step-by-step solutions from verified subject matter experts