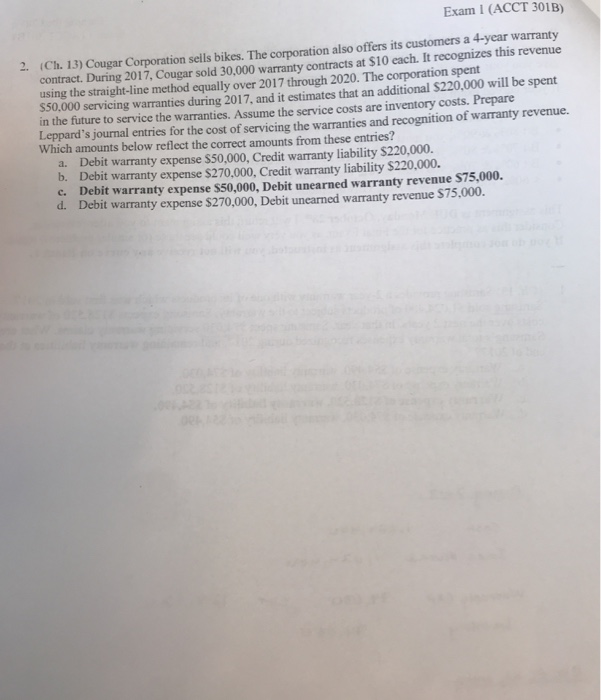

Question: how do you get c? Exam I (ACCT 301B) 2. (Ch. 13) Cougar Corporation sells bikes. The corporation also offers its customers a 4-year warranty

how do you get c?

Exam I (ACCT 301B) 2. (Ch. 13) Cougar Corporation sells bikes. The corporation also offers its customers a 4-year warranty contract. During 2017, Cougar sold 30,000 warranty contracts at $10 each. It recognizes this revenue using the straight-line method equally over 2017 through 2020. The corporation spent $50.000 servicing warranties during 2017, and it estimates that an additional $220,000 will be spent in the future to service the warranties. Assume the service costs are inventory costs. Prepare Leppard's journal entries for the cost of servicing the warranties and recognition of warranty revenue. Which amounts below reflect the correct amounts from these entries? a. Debit warranty expense $50,000, Credit warranty liability $220,000. b. Debit warranty expense $270,000, Credit warranty liability $220,000. c. Debit warranty expense $50,000, Debit unearned warranty revenue $75,000. d. Debit warranty expense $270,000, Debit unearned warranty revenue $75,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts