Question: how do you get number 6? Question 5 (6.25 points) Saved How should UCD utilize the forward market to hedge the exchange rate risk for

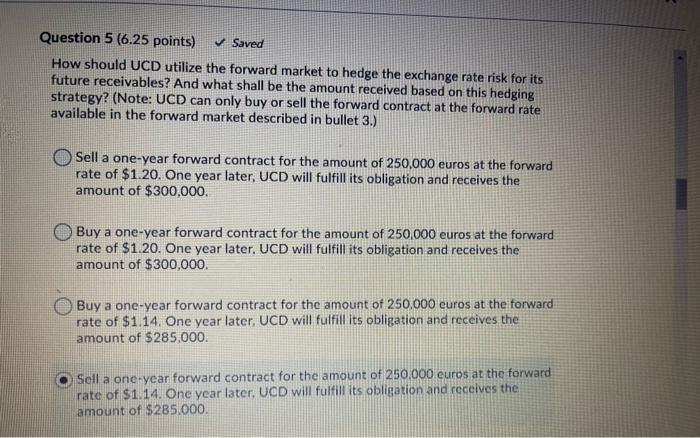

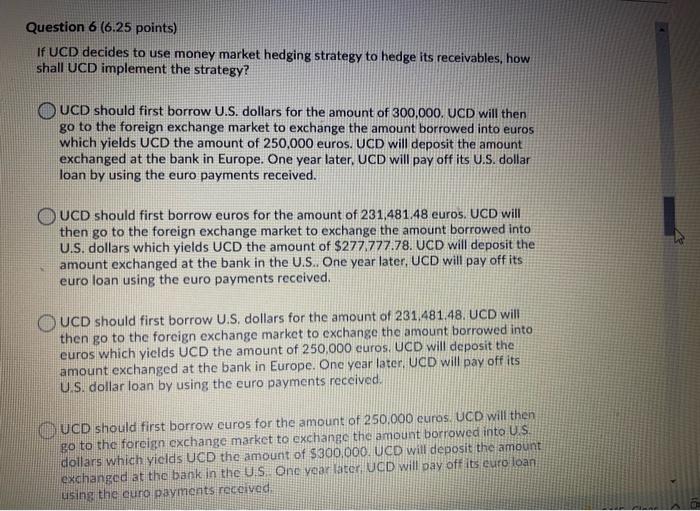

Question 5 (6.25 points) Saved How should UCD utilize the forward market to hedge the exchange rate risk for its future receivables? And what shall be the amount received based on this hedging strategy? (Note: UCD can only buy or sell the forward contract at the forward rate available in the forward market described in bullet 3.) Sell a one-year forward contract for the amount of 250,000 euros at the forward rate of $1.20. One year later, UCD will fulfill its obligation and receives the amount of $300,000. Buy a one-year forward contract for the amount of 250.000 euros at the forward rate of $1.20. One year later. UCD will fulfill its obligation and receives the amount of $300,000. Buy a one-year forward contract for the amount of 250.000 euros at the forward rate of $1.14. One year later. UCD will fulfill its obligation and receives the amount of $285,000. Sell a one-year forward contract for the amount of 250.000 euros at the forward rate of $1.14. One year later, UCD will fulfill its obligation and receives the amount of $285.000. Question 6 (6.25 points) If UCD decides to use money market hedging strategy to hedge its receivables, how shall UCD implement the strategy? UCD should first borrow U.S. dollars for the amount of 300,000. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 250,000 euros. UCD will deposit the amount exchanged at the bank in Europe. One year later, UCD will pay off its U.S. dollar loan by using the euro payments received. UCD should first borrow euros for the amount of 231.481.48 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $277.777.78. UCD will deposit the amount exchanged at the bank in the U.S.. One year later, UCD will pay off its euro loan using the euro payments received, UCD should first borrow U.S. dollars for the amount of 231.481.48. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 250.000 euros. UCD will deposit the amount exchanged at the bank in Europe. One year later, UCD will pay off its U.S. dollar loan by using the euro payments received. UCD should first borrow euros for the amount of 250.000 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $300,000. UCD will deposit the amount exchanged at the bank in the US One year later. UCD will pay offats euro loan using the cure payments received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts