Question: how do you get the answer Question 14 O out of 1 points It is now January 1, 2013, and you are considering the purchase

how do you get the answer

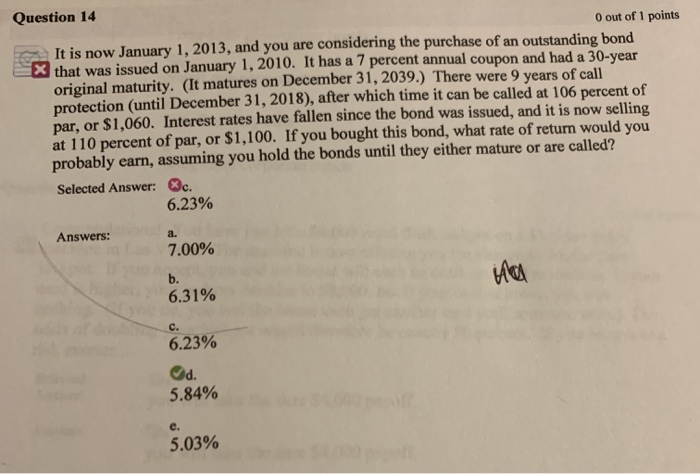

how do you get the answerQuestion 14 O out of 1 points It is now January 1, 2013, and you are considering the purchase of an outstanding bond X that was issued on January 1, 2010. It has a 7 percent annual coupon and had a 30-year original maturity. (It matures on December 31, 2039.) There were 9 years of call protection (until December 31, 2018), after which time it can be called at 106 percent of par, or $1,060. Interest rates have fallen since the bond was issued, and it is now selling at 110 percent of par, or $1,100. If you bought this bond, what rate of return would you probably earn, assuming you hold the bonds until they either mature or are called? Selected Answer: &c. 6.23% Answers: a. 7.00% b. 6.31% c. 6.23% d. 5.84% e. 5.03%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts