Question: how do you get the answers for the cash flow using this information? C. JTM's can its $150M in bonds - maturing in 7 years

how do you get the answers for the cash flow using this information?

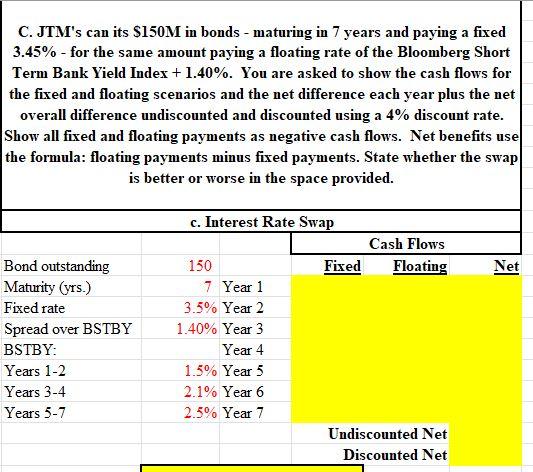

C. JTM's can its $150M in bonds - maturing in 7 years and paying a fixed 3.45% - for the same amount paying a floating rate of the Bloomberg Short Term Bank Yield Index + 1.40%. You are asked to show the cash flows for the fixed and floating scenarios and the net difference each year plus the net overall difference undiscounted and discounted using a 4% discount rate. Show all fixed and floating payments as negative cash flows. Net benefits use the formula: floating payments minus fixed payments. State whether the swap is better or worse in the space provided. Net Bond outstanding Maturity (yrs.) Fixed rate Spread over BSTBY BSTBY: Years 1-2 Years 3-4 Years 5-7 c. Interest Rate Swap Cash Flows 150 Fixed Floating 7 Year 1 3.5% Year 2 1.40% Year 3 Year 4 1.5% Year 5 2.1% Year 6 2.5% Year 7 Undiscounted Net Discounted Net C. JTM's can its $150M in bonds - maturing in 7 years and paying a fixed 3.45% - for the same amount paying a floating rate of the Bloomberg Short Term Bank Yield Index + 1.40%. You are asked to show the cash flows for the fixed and floating scenarios and the net difference each year plus the net overall difference undiscounted and discounted using a 4% discount rate. Show all fixed and floating payments as negative cash flows. Net benefits use the formula: floating payments minus fixed payments. State whether the swap is better or worse in the space provided. Net Bond outstanding Maturity (yrs.) Fixed rate Spread over BSTBY BSTBY: Years 1-2 Years 3-4 Years 5-7 c. Interest Rate Swap Cash Flows 150 Fixed Floating 7 Year 1 3.5% Year 2 1.40% Year 3 Year 4 1.5% Year 5 2.1% Year 6 2.5% Year 7 Undiscounted Net Discounted Net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts