Question: How do you get these answers ? Three years ago, you founded Outdoor Recreation, Inc., a retailer specializing in the sale of equipment and clothing

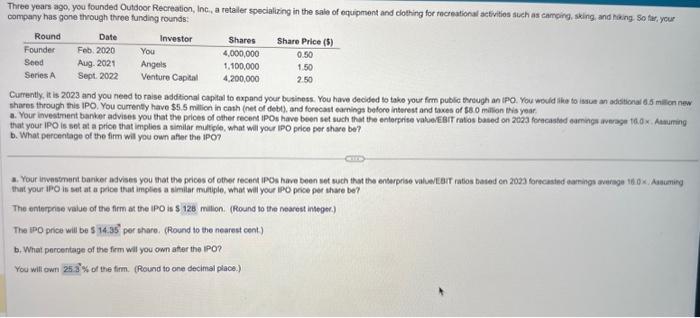

Three years ago, you founded Outdoor Recreation, Inc., a retailer specializing in the sale of equipment and clothing for recreational activities such as camping, skiing, and hiking. So far, your company has gone through three funding rounds:

Round

Founder

Seed

Series A

Date

Feb. 2020

Aug. 2021

Sept. 2022

Investor

You

Angels

Venture Capital

Shares

4,000,000

1,100,000

4,200,000

Share Price ($)

0.50

1.50

2.50

Currently, it is 2023 and you need to raise additional capital to expand your business. You have decided to take your firm public through an IPO. You would like to issue an additional 6.5 million new shares through this IPO. You currently have $5.5 million in cash (net of debt), and forecast earnings before interest and taxes of $8.0 million this year.

- Your investment banker advises you that the prices of other recent IPOs have been set such that the enterprise value/BIT ratios based on 2023 forecasted earnings average 16.0 . Assuming that your IPO is set at a price that implies a similar multiple, what will your IPO price per share be?

- What percentage of the firm will you own after the IPO?

a. Your investment banker advises you that the prices of other recent IPOs have been set such that the enterprise value/BIT ratios based on 2023 forecasted earnings average 16.0 . Assuming that your IPO is set at a price that implies a similar multiple, what will your IPO price per share be?

The enterprise value of the firm at the IPO is $ 128 million. (Round to the nearest integer.)

The IPO price will be $ 14.35 per share. (Round to the nearest cent.)

b. What percentage of the firm will you own after the IPO?

You will own 25.3 % of the firm. (Round to one decimal place.)

that your IPO is set at a price that implies a similar multiple, what wal your IPO price per share be? b. What percentage of the firm will you own afer the IPO? that your IPO is set at a proe that imples a similar muliple, what will your boO proce per thare be? The enterpese value of the firm at the IPO is $. mulion. (Round to the nearest integer.) The IPO price will be 514.353 per thare. (Round to the nearest cent) b. What percentage of the firm will you own ater the IPO? You wili own Sof the firm. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts