Question: how do you get this question not using excel A 21 AA WEB AaBbCcDc AaBbCcDc AaBbcc AaBbccc Aa 1 Normal 1 No Spac. Heading 1

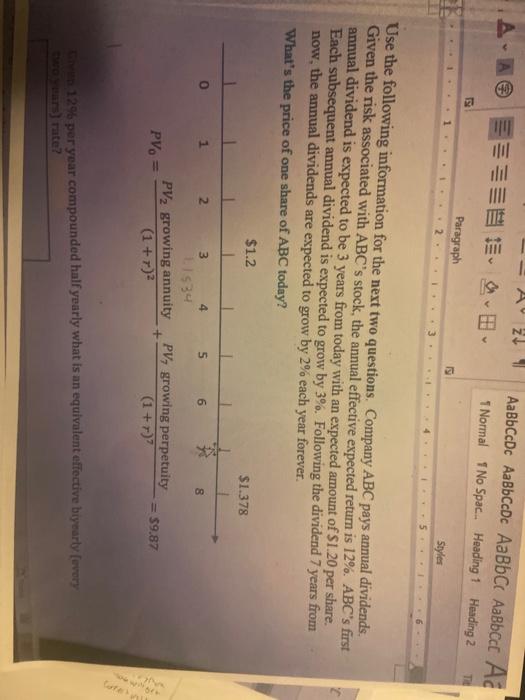

A 21 AA WEB AaBbCcDc AaBbCcDc AaBbcc AaBbccc Aa 1 Normal 1 No Spac. Heading 1 Heading 2 5 TE Paragraph Styles Use the following information for the next two questions. Company ABC pays annual dividends. Given the risk associated with ABC's stock, the annual effective expected return is 12%. ABC's first annual dividend is expected to be 3 years from today with an expected amount of $1.20 per share. Each subsequent annual dividend is expected to grow by 3%. Following the dividend 7 years from now, the annual dividends are expected to grow by 2% each year forever. What's the price of one share of ABC today? $1.2 $1.378 5 6 2 3 4 L1534 PV2 growing annuity PVo = (1 + r)? PV, growing perpetuity + (1 + r)? = 59.87 VE 12% per year compounded half yearly what is an equivalent effective biyearly (every romans) rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts