Question: how do you input these in the journal? Issued a $15,000 ACH payment to First American Bank and Trust for partial payment on the bank

how do you input these in the journal?

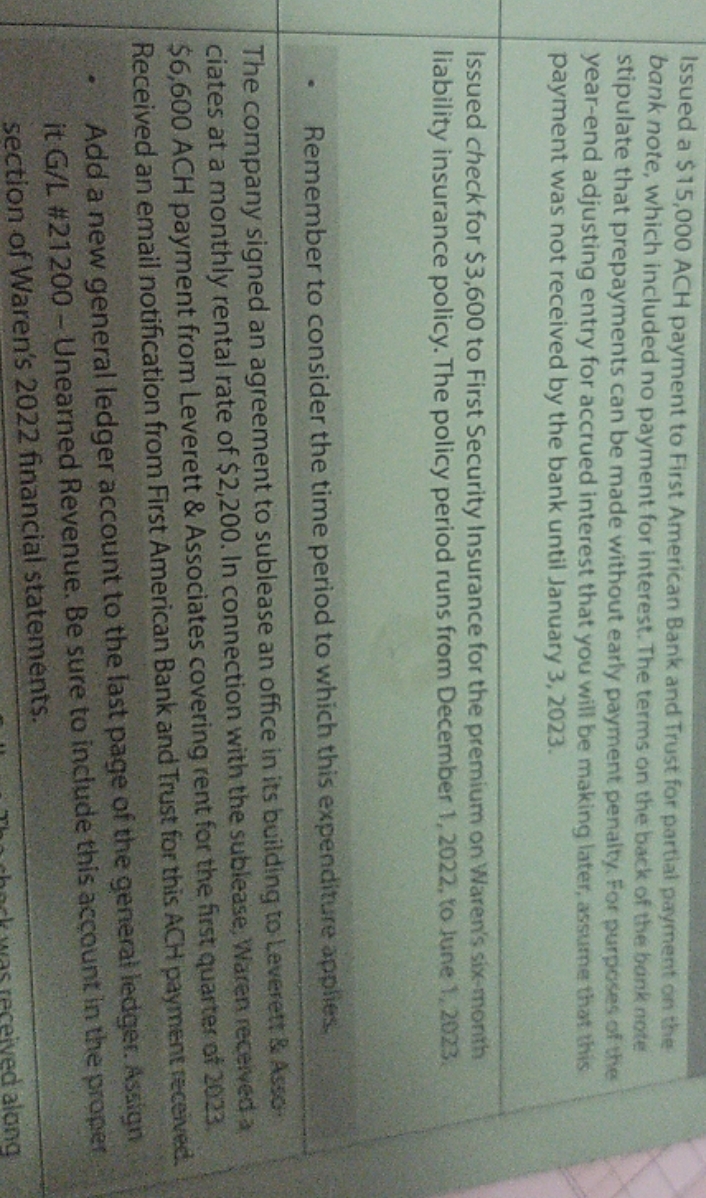

Issued a $15,000 ACH payment to First American Bank and Trust for partial payment on the bank note, which included no payment for interest. The terms on the back of the bank note stipulate that prepayments can be made without early payment penalty For purposes of the year-end adjusting entry for accrued interest that you will be making later, assume that this payment was not received by the bank until January 3, 2023. Issued check for $3,600 to First Security Insurance for the premium on Waren's six-month liability insurance policy. The policy period runs from December 1, 2022, to June 1, 2023 . Remember to consider the time period to which this expenditure applies. The company signed an agreement to sublease an office in its building to Leverett & Asso ciates at a monthly rental rate of $2,200. In connection with the sublease, Waren received a $6,600 ACH payment from Leverett & Associates covering rent for the first quarter of 2023 Received an email notification from First American Bank and Trust for this ACH payment received. Add a new general ledger account to the last page of the general ledger. Assign it G/L #21200 - Unearned Revenue. Be sure to include this account in the proper section of Waren's 2022 financial statements. eceived along

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts