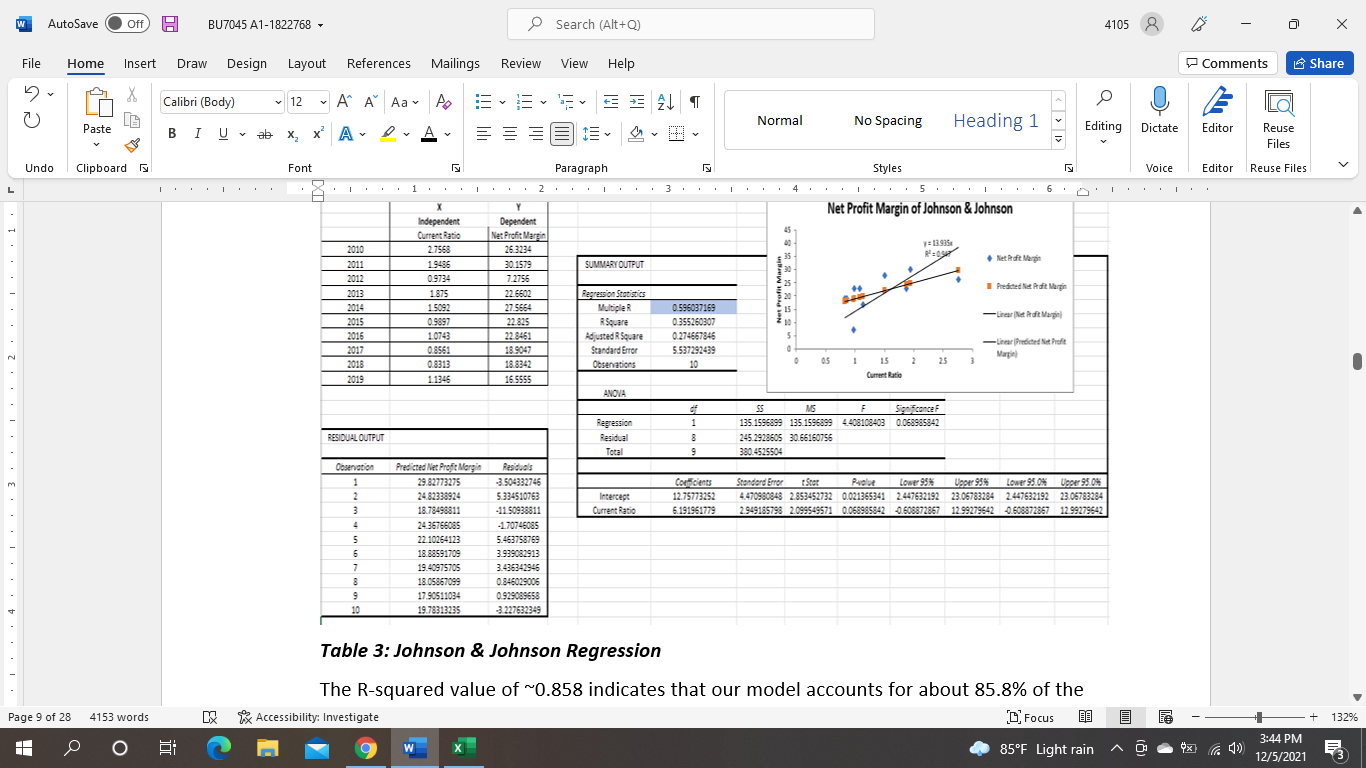

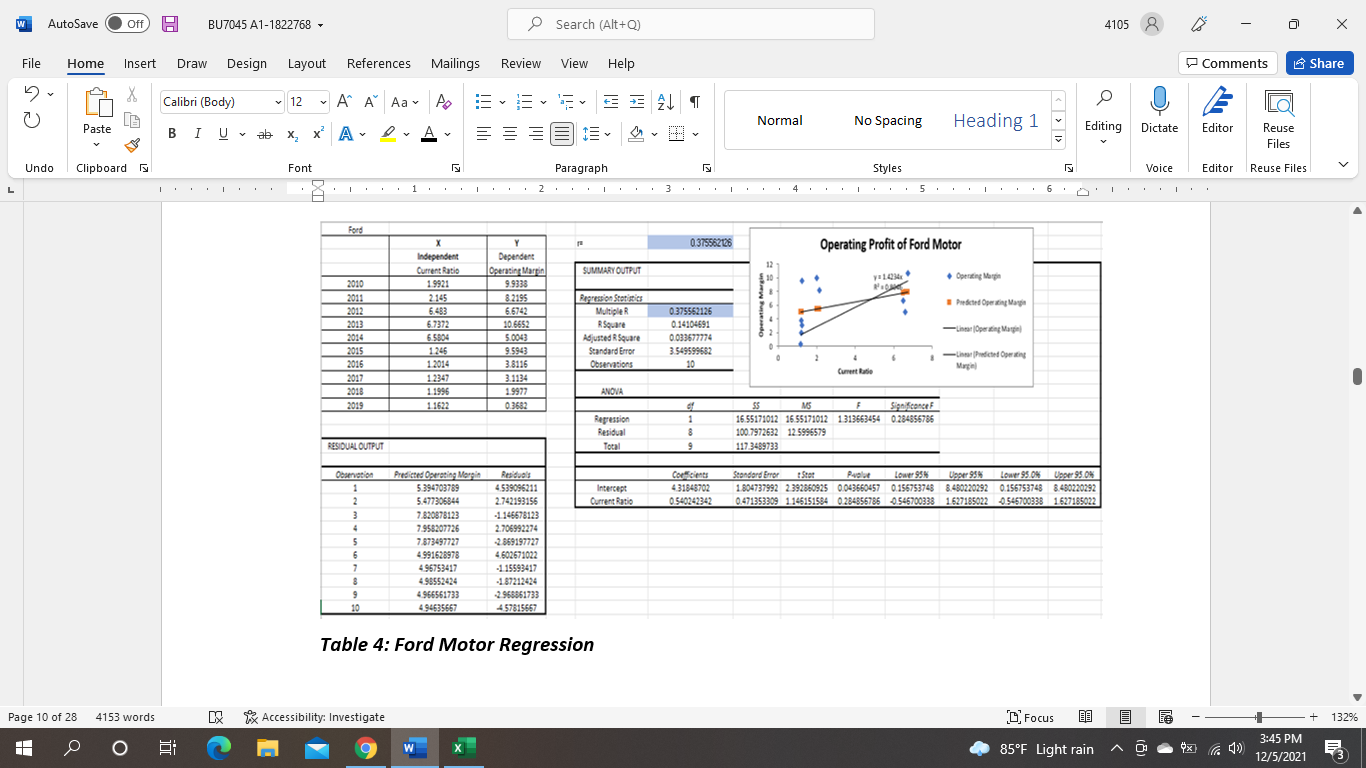

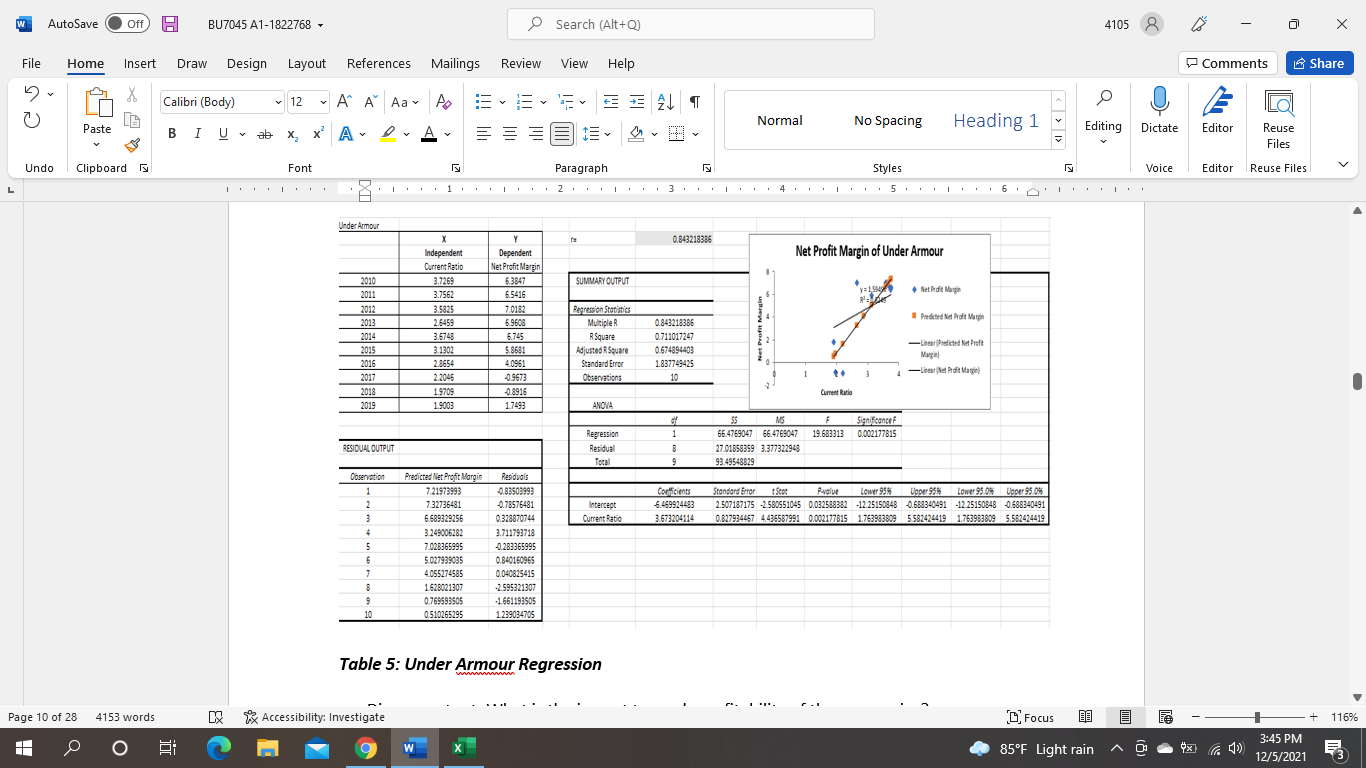

Question: How do you interpret this data regression of Johnson & Johnson's company, Under Armour and Ford Motor respectively. Explain in details on the findings. W

How do you interpret this data regression of Johnson & Johnson's company, Under Armour and Ford Motor respectively. Explain in details on the findings.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts