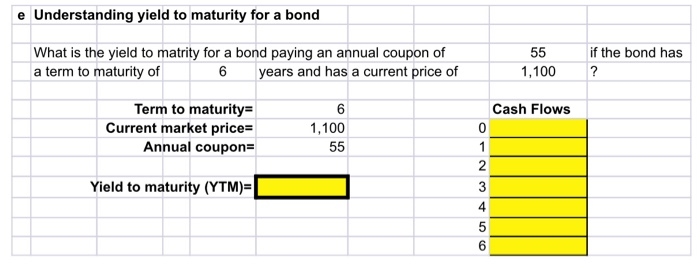

Question: How do you solve these problems? e Understanding yield to maturity for a bond What is the yield to matrity for a bond paying an

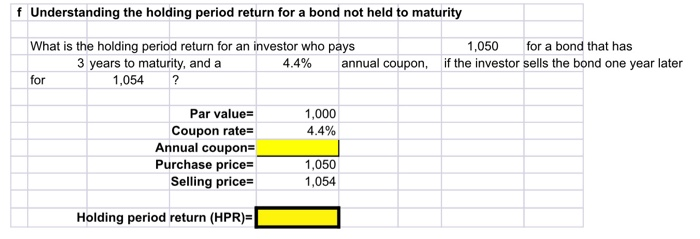

e Understanding yield to maturity for a bond What is the yield to matrity for a bond paying an annual coupon of a term to maturity of 6 years and has a current price of 55 1,100 if the bond has ? Term to maturity= Current market price= Annual coupons 6 1,100 55 Cash Flows 0 1 2 3 Yield to maturity (YTM)= 4 5 6 f Understanding the holding period return for a bond not held to maturity What is the holding period return for an investor who pays 1,050 for a bond that has 3 years to maturity, and a 4.4% annual coupon, if the investor sells the bond one year later for 1,054 ? 1,000 4.4% Par value= Coupon rate- Annual coupons Purchase price Selling prices 1,050 1,054 Holding period return (HPR)=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts