Question: How do you solve these problems given the information on excel? Excel Online Structured Activity: Capital budgeting criteria A company has a 13% WACC and

How do you solve these problems given the information on excel?

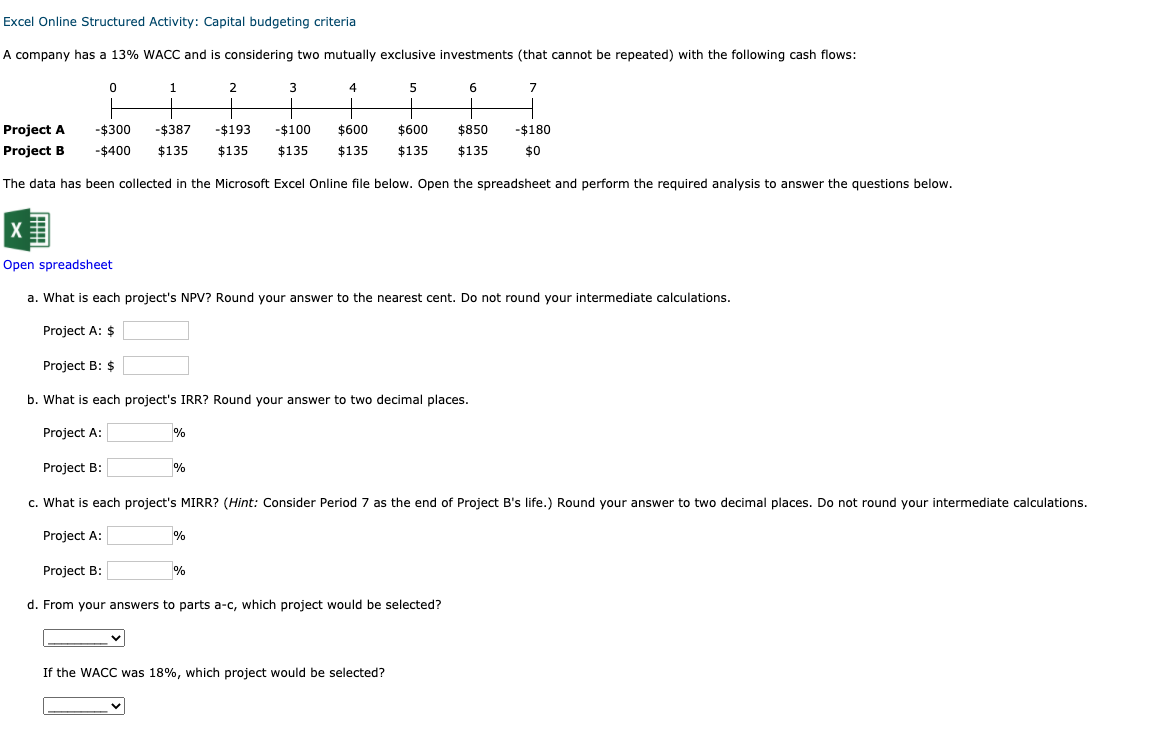

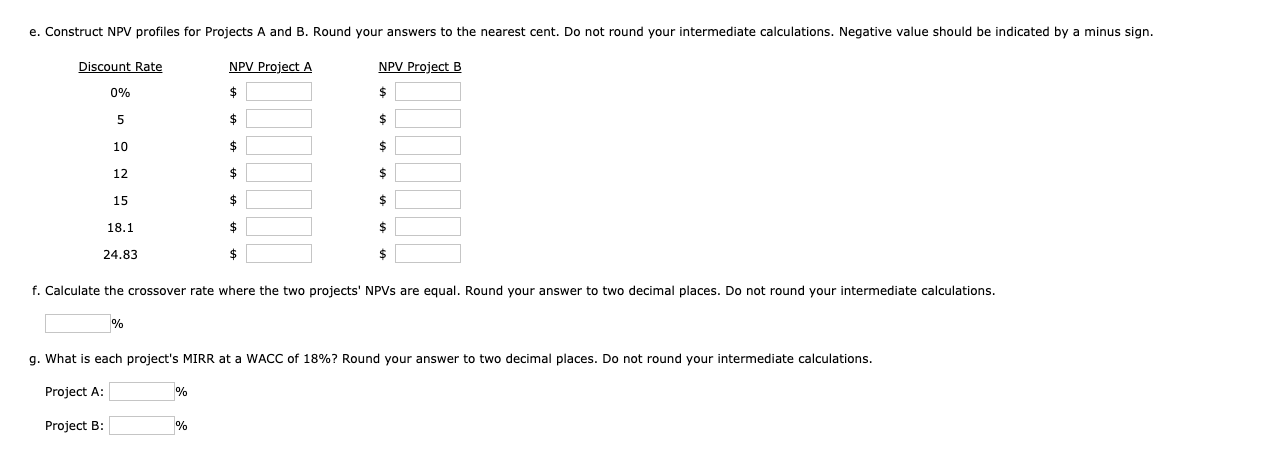

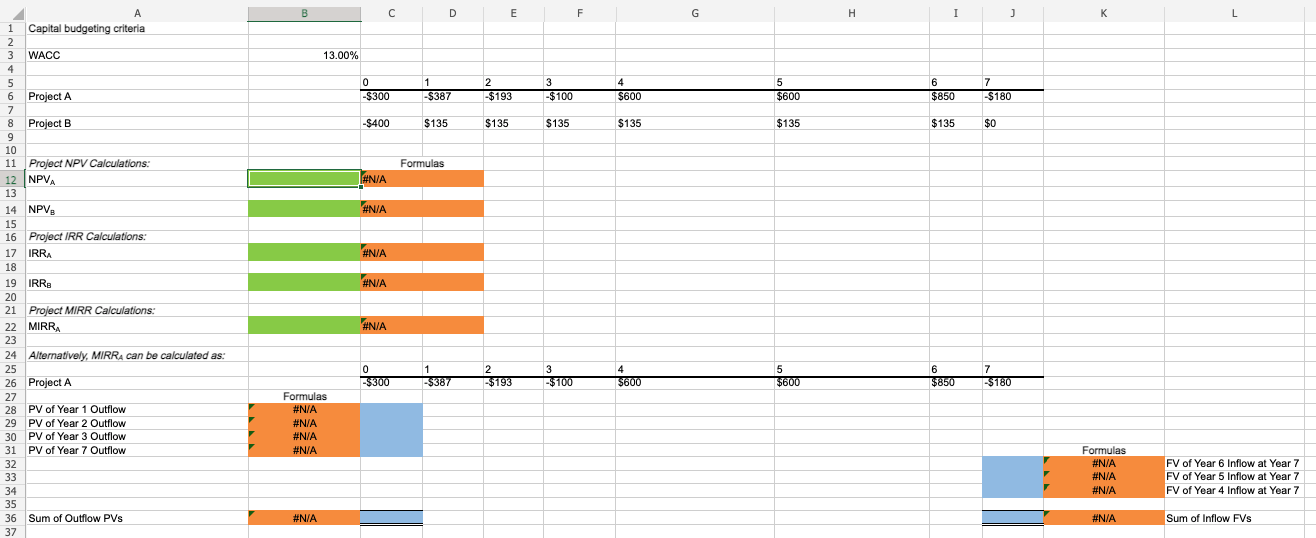

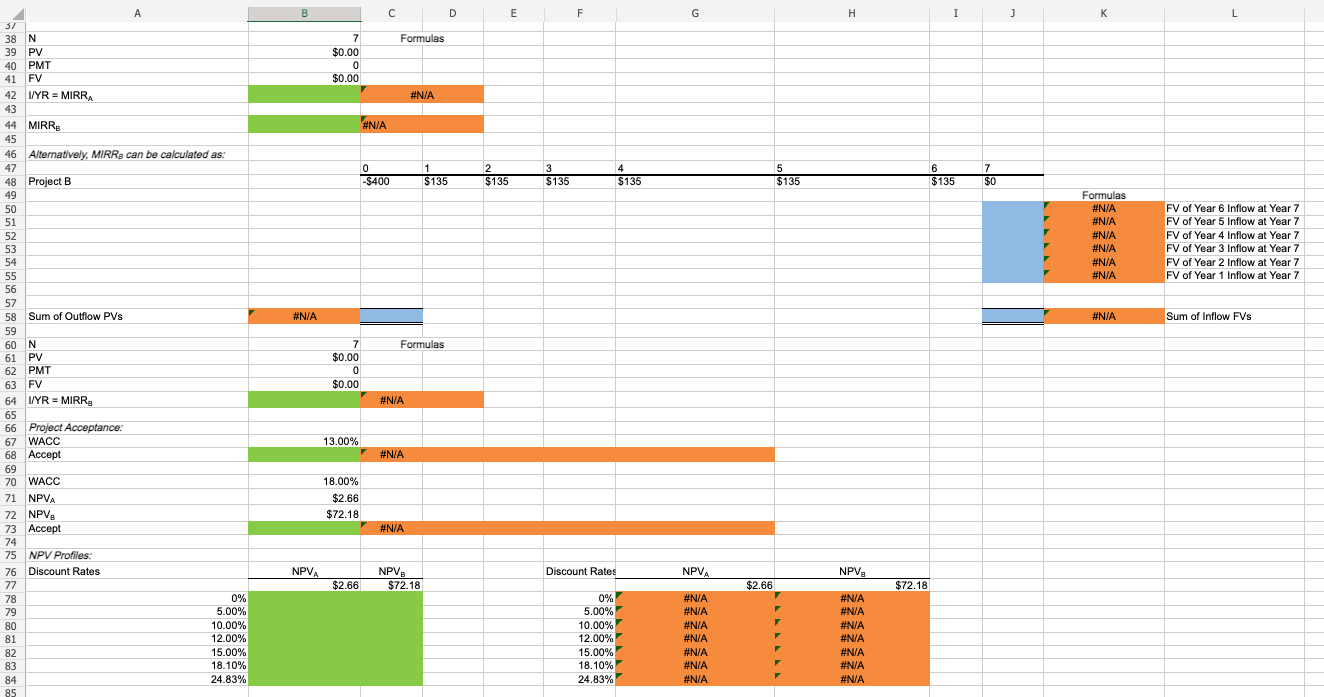

Excel Online Structured Activity: Capital budgeting criteria A company has a 13% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 0 1 2 3 4 5 6 7 Project A Project B -$300 -$400 -$387 $135 -$193 $135 -$100 $135 $600 $135 $600 $135 $850 $135 -$180 $0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: % Project B: % c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. Discount Rate NPV Project A NPV Project B 0% $ $ 5 $ $ 10 $ $ 12 $ $ 15 $ $ 18.1 $ 24.83 $ $ f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations. % g. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: % B D E F G H I ) L 13.00% 0 -$300 1 -$387 2 -$193 3 -$100 4 $600 5 $600 6 $850 7 $180 -$400 $135 $135 $135 $135 $135 $135 $0 Formulas #N/A #N/A #N/A 1 Capital budgeting criteria 2 3 WACC 4 5 6 Project A 7 8 8 Project B 9 10 11 Project NPV Calculations: 12 NPVA 13 14 NPVE 15 16 Project IRR Calculations: 17 IRRA 18 19 IRRE 20 21 Project MIRR Calculations: 22 MIRRA 23 24 Alternatively, MIRRA can be calculated as: 25 26 Project A 27 28 PV of Year 1 Outflow 29 PV of Year 2 Outflow 30 PV of Year 3 Outflow 31 PV of Year 7 Outflow 32 33 34 35 36 Sum of Outflow PVS 37 #N/A #N/A 7 0 -$300 1 -$3787 2 $193 3 -$100 4 S600 5 $600 6 $850 Formulas #N/A #N/A #N/A #N/A Formulas #N/A #N/A #N/A FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 #N/A #N/A Sum of Inflow FVs B D E F G G H I K L Formulas 7 $0.00 0 $0.00 $ #N/A #N/A 0 -$400 1 $135 2 $135 3 $135 4 $135 5 $135 6 $135 7 $0 Formulas #N/A #N/A #N/A #N/A #N/A #N/A FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 FV of Year 3 Inflow at Year 7 FV of Year 2 Inflow at Year 7 FV of Year 1 Inflow at Year 7 #N/A #N/A Sum of Inflow FVs Formulas 37 38 N 39 PV 40 PMT 41 FV 42 l/YR = MIRRA 43 44 MIRR. 45 46 Alternatively, MIRR can be calculated as: 47 48 Project B 49 50 51 52 53 54 55 56 57 58 Sum of Outflow PVS 59 60 N 61 PV 62 PMT 63 FV 64 L/YR = MIRRE 65 66 Project Acceptance: 67 WACC 68 Accept 69 70 WACC 71 NPVA 72 NPV, 73 Accept 74 75 NPV Profiles: 76 Discount Rates 77 78 0% 79 5.00% 80 10.00% 81 12.00% 82 15.00% 83 18.10% 84 24.83% 85 7 $0.00 0 $0.00 #N/A 13.00% #N/A 18.00% $2.66 $72.18 #N/A NPVA Discount Rates NPVA NPV $72.18 NPV. $2.66 $2.66 $72.18 0% 5.00% 10.00% 12.00% 15.00% 18.10% 24.83% #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #NA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts