Question: How do you solve these problems using a financial calculator? 1. On September 13, 2017, you inherited one Bitcoin from a relative's estate valued at

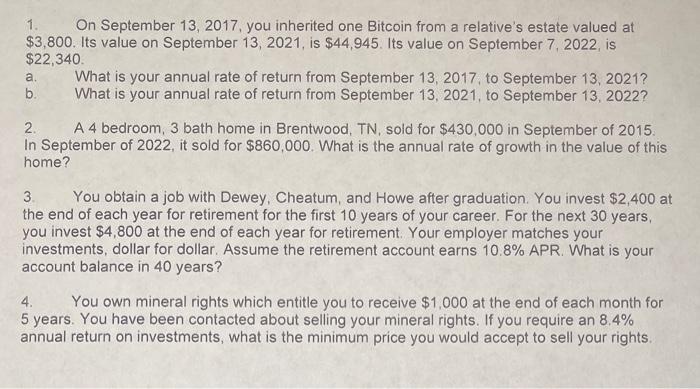

1. On September 13, 2017, you inherited one Bitcoin from a relative's estate valued at $3,800. Its value on September 13, 2021, is $44,945. Its value on September 7,2022 , is $22,340 a. What is your annual rate of return from September 13,2017 , to September 13,2021 ? b. What is your annual rate of return from September 13, 2021, to September 13,2022 ? 2. A 4 bedroom, 3 bath home in Brentwood, TN, sold for $430,000 in September of 2015 . In September of 2022 , it sold for $860,000. What is the annual rate of growth in the value of this home? 3. You obtain a job with Dewey, Cheatum, and Howe after graduation. You invest $2,400 at the end of each year for retirement for the first 10 years of your career. For the next 30 years, you invest $4,800 at the end of each year for retirement. Your employer matches your investments, dollar for dollar. Assume the retirement account earns 10.8% APR. What is your account balance in 40 years? 4. You own mineral rights which entitle you to receive $1,000 at the end of each month for 5 years. You have been contacted about selling your mineral rights. If you require an 8.4% annual return on investments, what is the minimum price you would accept to sell your rights. 1. On September 13, 2017, you inherited one Bitcoin from a relative's estate valued at $3,800. Its value on September 13, 2021, is $44,945. Its value on September 7,2022 , is $22,340 a. What is your annual rate of return from September 13,2017 , to September 13,2021 ? b. What is your annual rate of return from September 13, 2021, to September 13,2022 ? 2. A 4 bedroom, 3 bath home in Brentwood, TN, sold for $430,000 in September of 2015 . In September of 2022 , it sold for $860,000. What is the annual rate of growth in the value of this home? 3. You obtain a job with Dewey, Cheatum, and Howe after graduation. You invest $2,400 at the end of each year for retirement for the first 10 years of your career. For the next 30 years, you invest $4,800 at the end of each year for retirement. Your employer matches your investments, dollar for dollar. Assume the retirement account earns 10.8% APR. What is your account balance in 40 years? 4. You own mineral rights which entitle you to receive $1,000 at the end of each month for 5 years. You have been contacted about selling your mineral rights. If you require an 8.4% annual return on investments, what is the minimum price you would accept to sell your rights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts