Question: how do you solve this ? 1. Adjusting entries 1. on January 1 of the current year, Bambi company paid $1,200 rent to cover six

how do you solve this ?

how do you solve this ?

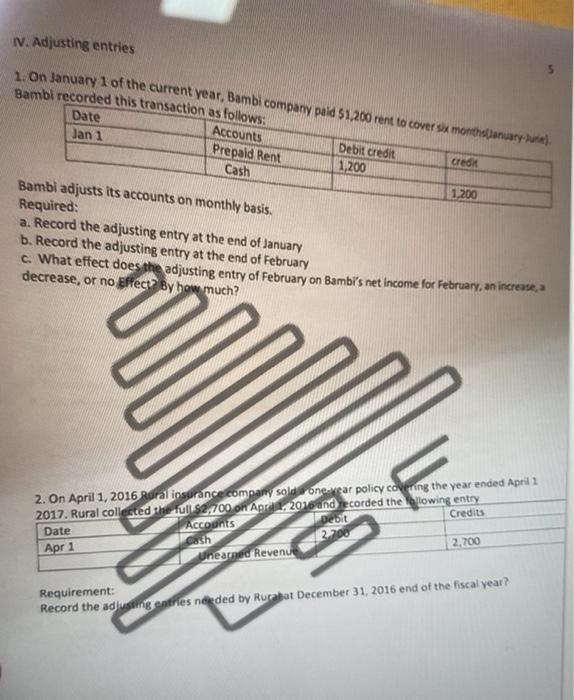

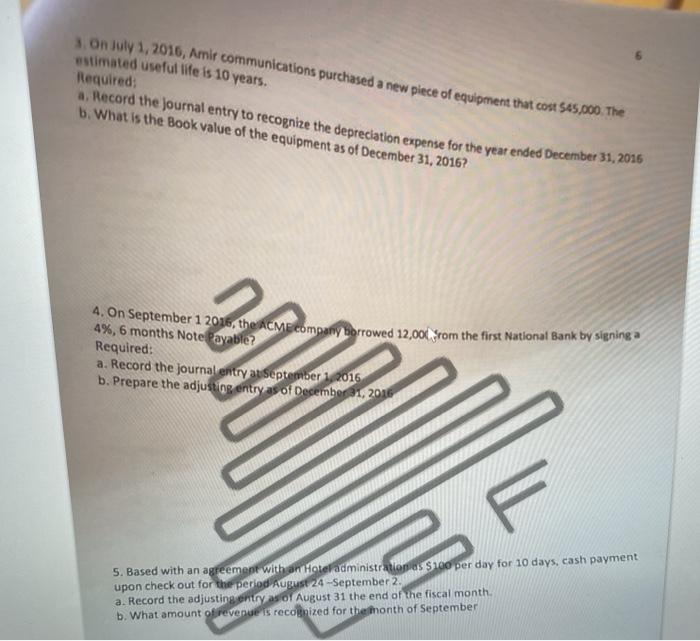

1. Adjusting entries 1. on January 1 of the current year, Bambi company paid $1,200 rent to cover six monthnuary. Duma). Bambi recorded this transaction as follows: Date Accounts Debit credit Credit Jan 1 Prepaid Rent 1,200 Cash 1,200 Bambi adjusts its accounts on monthly basis. Required: a. Record the adjusting entry at the end of January b. Record the adjusting entry at the end of February c. What effect does the adjusting entry of February on Bambi's net income for February, an increase decrease, or no effect 2 By how much? 2. On April 1, 2016 Rural insurance company sold one wear policy covering the year ended April 1 2017. Rural collected the full $2,100 on April 2016 and recorded the following entry Date Accounts Debit Credits Apr 1 Gash 12200 Unearned Revenue 2,700 Requirement: Record the ad iusting entries needed by Ruraber December 31, 2016 end of the fiscal year? 3 on Joly 1, 2016, Amir communications purchased a new piece of equipment that cont SAS,000. The estimated useful life is 10 years. aRecord the Journal entry to recognize the depreciation expense for the year ended December 31, 2016 5. What is the Book value of the equipment as of December 31, 2016? Required: 4. On September 1 2016, the amp company borrowed 12,000 from the first National Bank by siening 4%, 6 months Note Payable? Required: a. Record the journal entry auSeptember 2016 b. Prepare the adjusting entry as of December 1, 2016 5. Based with an agreement with an Hotel administration as soo per day for 10 days, cash payment upon check out for the period August 24-September 2. a. Record the adjusting entry as of August 31 the end of the fiscal month. b. What amount of revenue is recognized for the month of September

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts