Question: how do you solve this? 15. In item #14 above, what is the firm's WACC assuming its target debt-equity is 50 percent, and its cost

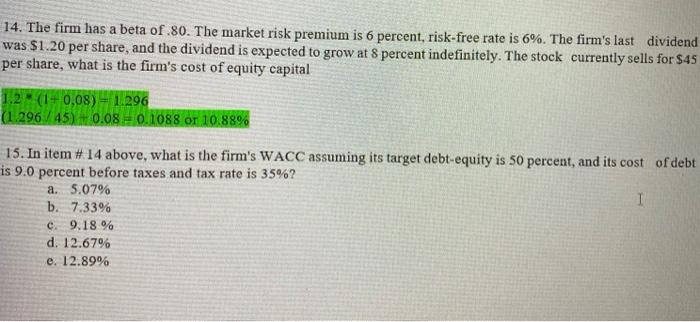

15. In item #14 above, what is the firm's WACC assuming its target debt-equity is 50 percent, and its cost of debt is 9.0 percent before taxes and tax rate is 35%? a. 5.07% b. 7.33% c. 9.18% d. 12.67% I e. 12.89% 14. The firm has a beta of 80. The market risk premium is 6 percent, risk-free rate is 6%. The firm's last dividend was $1.20 per share, and the dividend is expected to grow at 8 percent indefinitely. The stock currently sells for $45 per share, what is the firm's cost of equity capital 1.2 (1+0,08) - 1.296 (1.296 / 45) 0.08 = 0.1088 or 10.88% 15. In item #14 above, what is the firm's WACC assuming its target debt-equity is 50 percent, and its cost of debt is 9.0 percent before taxes and tax rate is 35%? a. 5.07% 1 b. 7.33% c. 9.18 % d. 12.67% e. 12.89%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts