Question: how do you solve this? answer is B 7. Gateway Tours is choosing between two bus models. The Old Reliable bus model has an expected

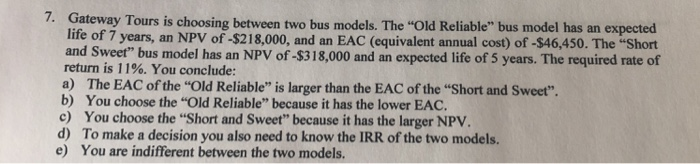

7. Gateway Tours is choosing between two bus models. The "Old Reliable" bus model has an expected life of 7 years, an NPV of -$218,000, and an EAC (equivalent annual cost) of -$46,450. The "Short and Sweet" bus model has an NPV of-$318,000 and an expected life of 5 years. The required rate of return is 11%. You conclude: a) The EAC of the "Old Reliable" is larger than the EAC of the "Short and Sweet". b) You choose the "Old Reliable" because it has the lower EAC. c) You choose the "Short and Sweet" because it has the larger NPV. d) To make a decision you also need to know the IRR of the two models. e) You are indifferent between the two models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts