Question: How do you solve this on excel ? A six-year government bond makes annual coupon payments of 5% and offers a yield of 4% annually

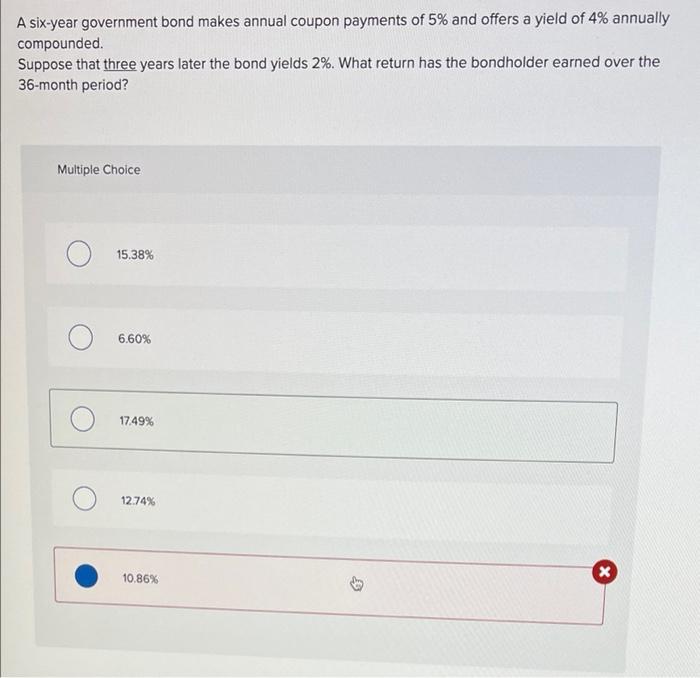

A six-year government bond makes annual coupon payments of 5% and offers a yield of 4% annually compounded. Suppose that three years later the bond yields 2%. What return has the bondholder earned over the 36-month period? Multiple Choice 15.38% 6.60% 17.49% 12.74% x 10.86%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts