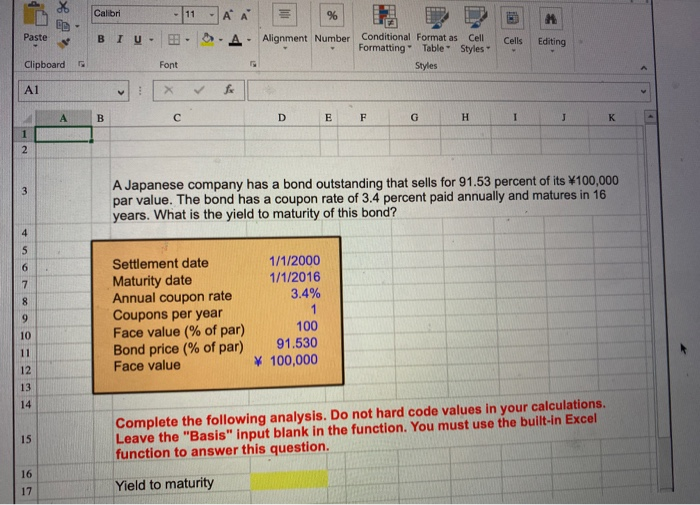

Question: how do you solve this problem using the =YIELD formula on excel? X Calibri -11 - A A A. Paste B I U - Cells

X Calibri -11 - A A A. Paste B I U - Cells Editing Alignment Number Conditional Format as Cell - Formatting Table - Styles Styles Clipboard Font A1 E G H A Japanese company has a bond outstanding that sells for 91.53 percent of its W100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? 1/1/2000 1/1/2016 3.4% Settlement date Maturity date Annual coupon rate Coupons per year Face value (% of par) Bond price (% of par) Face value 100 91.530 * 100,000 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts