Question: How do you solve this question? I have no idea how to start. A one-year Treasury STRIP with a face value of $1,000 matures exactly

How do you solve this question? I have no idea how to start.

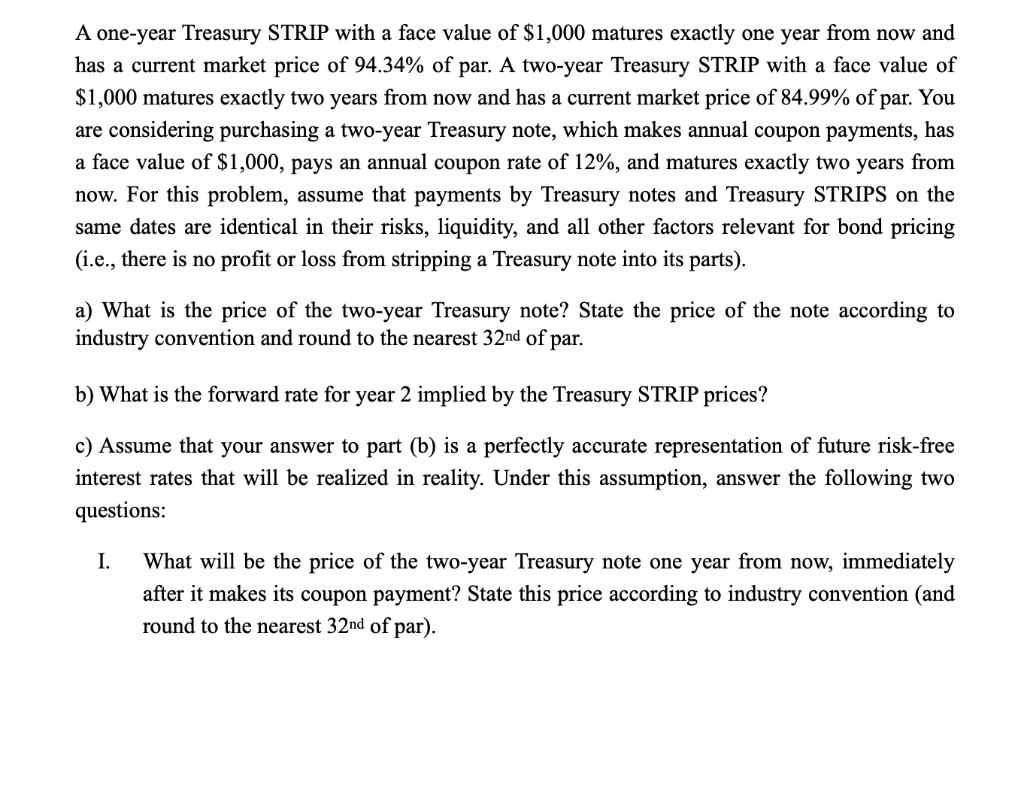

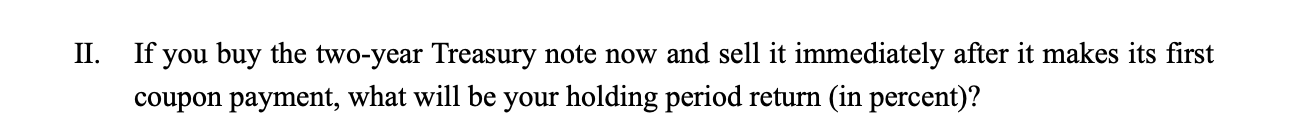

A one-year Treasury STRIP with a face value of $1,000 matures exactly one year from now and has a current market price of 94.34% of par. A two-year Treasury STRIP with a face value of $1,000 matures exactly two years from now and has a current market price of 84.99% of par. You are considering purchasing a two-year Treasury note, which makes annual coupon payments, has a face value of $1,000, pays an annual coupon rate of 12%, and matures exactly two years from now. For this problem, assume that payments by Treasury notes and Treasury STRIPS on the same dates are identical in their risks, liquidity, and all other factors relevant for bond pricing (i.e., there is no profit or loss from stripping a Treasury note into its parts). a) What is the price of the two-year Treasury note? State the price of the note according to industry convention and round to the nearest 32nd of par. b) What is the forward rate for year 2 implied by the Treasury STRIP prices? c) Assume that your answer to part (b) is a perfectly accurate representation of future risk-free interest rates that will be realized in reality. Under this assumption, answer the following two questions: I. What will be the price of the two-year Treasury note one year from now, immediately after it makes its coupon payment? State this price according to industry convention (and round to the nearest 32nd of par). II. If you buy the two-year Treasury note now and sell it immediately after it makes its first coupon payment, what will be your holding period return (in percent)? A one-year Treasury STRIP with a face value of $1,000 matures exactly one year from now and has a current market price of 94.34% of par. A two-year Treasury STRIP with a face value of $1,000 matures exactly two years from now and has a current market price of 84.99% of par. You are considering purchasing a two-year Treasury note, which makes annual coupon payments, has a face value of $1,000, pays an annual coupon rate of 12%, and matures exactly two years from now. For this problem, assume that payments by Treasury notes and Treasury STRIPS on the same dates are identical in their risks, liquidity, and all other factors relevant for bond pricing (i.e., there is no profit or loss from stripping a Treasury note into its parts). a) What is the price of the two-year Treasury note? State the price of the note according to industry convention and round to the nearest 32nd of par. b) What is the forward rate for year 2 implied by the Treasury STRIP prices? c) Assume that your answer to part (b) is a perfectly accurate representation of future risk-free interest rates that will be realized in reality. Under this assumption, answer the following two questions: I. What will be the price of the two-year Treasury note one year from now, immediately after it makes its coupon payment? State this price according to industry convention (and round to the nearest 32nd of par). II. If you buy the two-year Treasury note now and sell it immediately after it makes its first coupon payment, what will be your holding period return (in percent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts