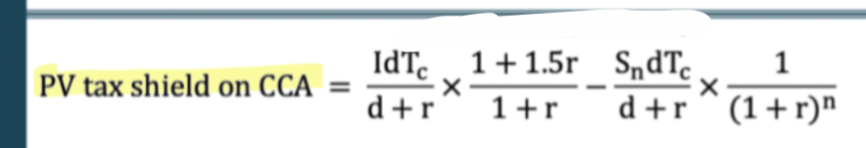

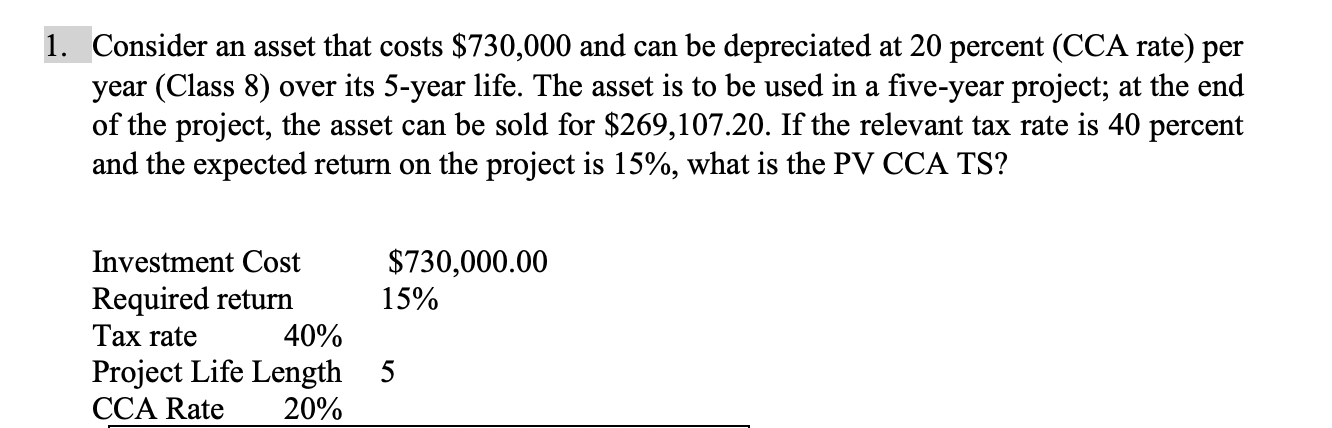

Question: How do you solve this question using the formula provided? CCA=d+rIdTc1+r1+1.5rd+rSndTc(1+r)n1 Consider an asset that costs $730,000 and can be depreciated at 20 percent (CCA

How do you solve this question using the formula provided?

CCA=d+rIdTc1+r1+1.5rd+rSndTc(1+r)n1 Consider an asset that costs $730,000 and can be depreciated at 20 percent (CCA rate) per year (Class 8) over its 5-year life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $269,107.20. If the relevant tax rate is 40 percent and the expected return on the project is 15%, what is the PV CCA TS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock