Question: How do you use the goal seek function in excel to solve the following: What annual rate of property appreciation should you expect on the

How do you use the goal seek function in excel to solve the following: What annual rate of property appreciation should you expect on the property in order for the imputed rent to be zero? Do you think that this expectation is reasonable?

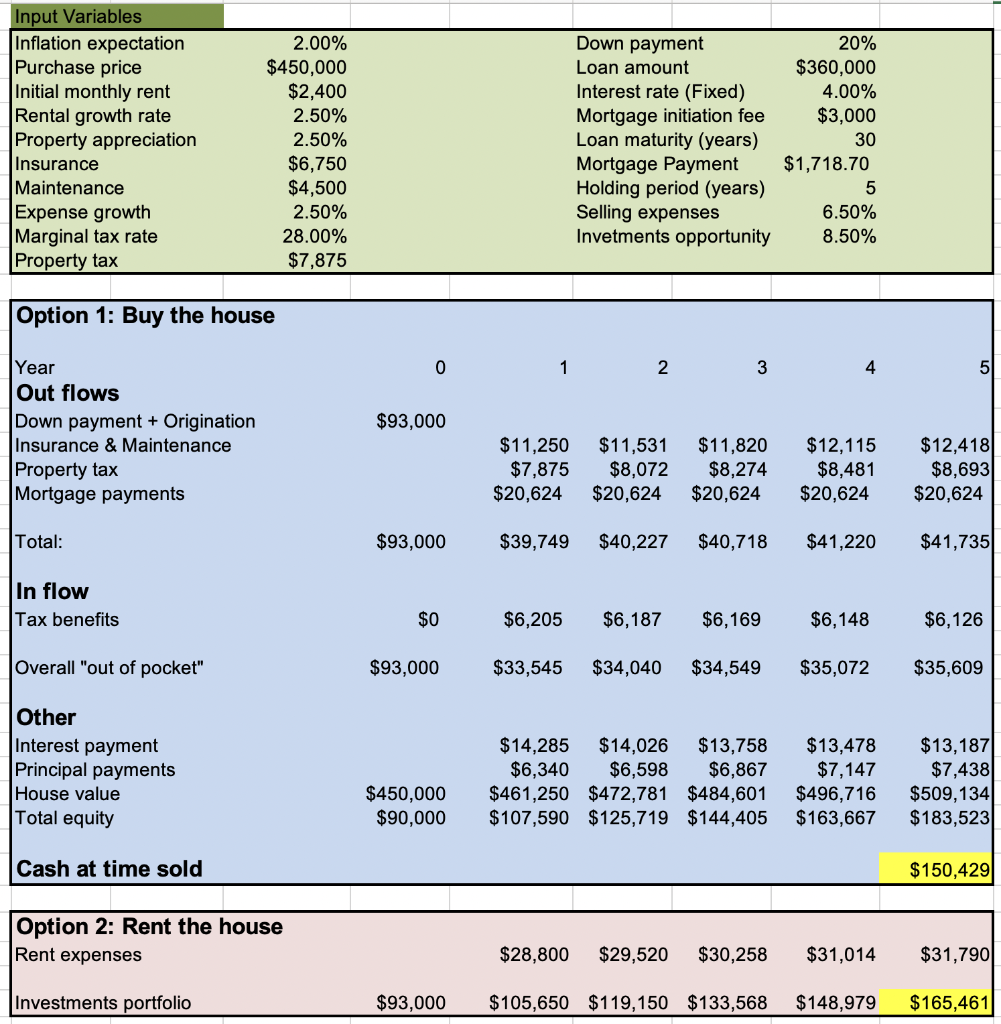

Input Variables Inflation expectation Purchase price Initial monthly rent Rental growth rate Property appreciation Insurance Maintenance Expense growth Marginal tax rate Property tax 2.00% $450,000 $2,400 2.50% 2.50% $6,750 $4,500 2.50% 28.00% $7,875 Down payment Loan amount Interest rate (Fixed) Mortgage initiation fee Loan maturity (years) Mortgage Payment Holding period (years) Selling expenses Invetments opportunity 20% $360,000 4.00% $3,000 30 $1,718.70 5 6.50% 8.50% Option 1: Buy the house 0 1 2 3 4 $93,000 Year Out flows Down payment + Origination Insurance & Maintenance Property tax Mortgage payments $11,250 $7,875 $20,624 $11,531 $8,072 $20,624 $11,820 $8,274 $20,624 $12,115 $8,481 $20,624 $12,418) $8,693 $20,624 Total: $93,000 $39,749 $40,227 $40,718 $41,220 $41,735 In flow Tax benefits $0 $6,205 $6,187 $6,169 $6,148 $6,126 Overall "out of pocket" $93,000 $33,545 $34,040 $34,549 $35,072 $35,609 Other Interest payment Principal payments House value Total equity $14,285 $14,026 $13,758 $6,340 $6,598 $6,867 $461,250 $472,781 $484,601 $107,590 $125,719 $144,405 $13,478 $7,147 $496,716 $163,667 $13,187 $7,438 $509,134 $183,523 $450,000 $90,000 Cash at time sold $150,429 Option 2: Rent the house Rent expenses $28,800 $29,520 $30,258 $31,014 $31,790 Investments portfolio $93,000 $105,650 $119,150 $133,568 $148,979 $165,461 Input Variables Inflation expectation Purchase price Initial monthly rent Rental growth rate Property appreciation Insurance Maintenance Expense growth Marginal tax rate Property tax 2.00% $450,000 $2,400 2.50% 2.50% $6,750 $4,500 2.50% 28.00% $7,875 Down payment Loan amount Interest rate (Fixed) Mortgage initiation fee Loan maturity (years) Mortgage Payment Holding period (years) Selling expenses Invetments opportunity 20% $360,000 4.00% $3,000 30 $1,718.70 5 6.50% 8.50% Option 1: Buy the house 0 1 2 3 4 $93,000 Year Out flows Down payment + Origination Insurance & Maintenance Property tax Mortgage payments $11,250 $7,875 $20,624 $11,531 $8,072 $20,624 $11,820 $8,274 $20,624 $12,115 $8,481 $20,624 $12,418) $8,693 $20,624 Total: $93,000 $39,749 $40,227 $40,718 $41,220 $41,735 In flow Tax benefits $0 $6,205 $6,187 $6,169 $6,148 $6,126 Overall "out of pocket" $93,000 $33,545 $34,040 $34,549 $35,072 $35,609 Other Interest payment Principal payments House value Total equity $14,285 $14,026 $13,758 $6,340 $6,598 $6,867 $461,250 $472,781 $484,601 $107,590 $125,719 $144,405 $13,478 $7,147 $496,716 $163,667 $13,187 $7,438 $509,134 $183,523 $450,000 $90,000 Cash at time sold $150,429 Option 2: Rent the house Rent expenses $28,800 $29,520 $30,258 $31,014 $31,790 Investments portfolio $93,000 $105,650 $119,150 $133,568 $148,979 $165,461

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts