Question: How does a change in the taxation rate affect the deferred tax estimate?A . The deferred tax estimate is adjusted only for future transactions, not

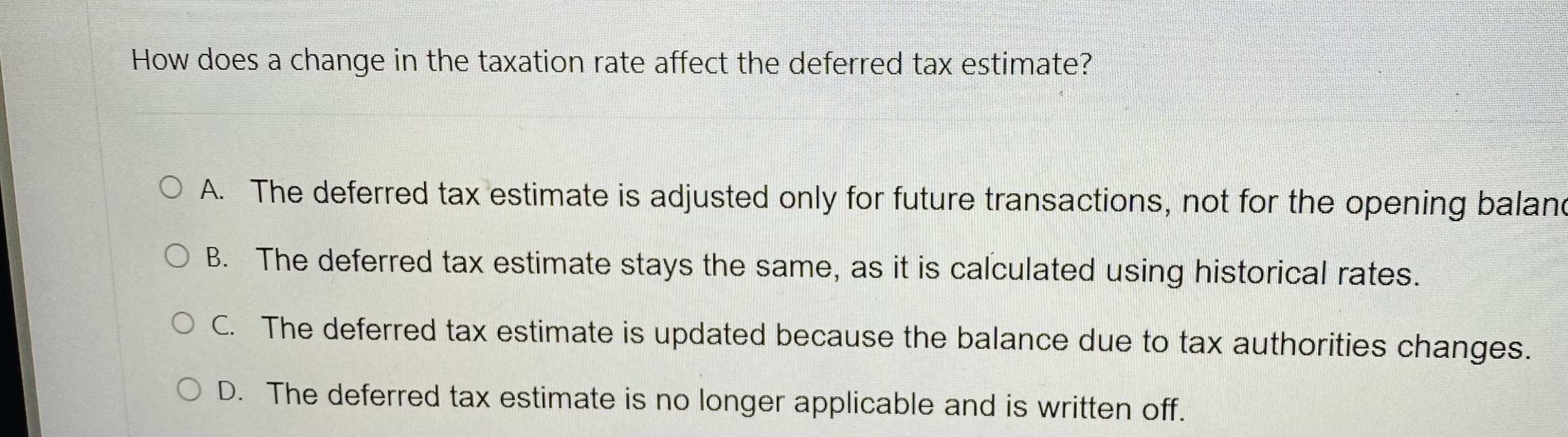

How does a change in the taxation rate affect the deferred tax estimate?A The deferred tax estimate is adjusted only for future transactions, not for the opening balanB. The deferred tax estimate stays the same, as it is calculated using historical rates.C The deferred tax estimate is updated because the balance due to tax authorities changes.D The deferred tax estimate is no longer applicable and is written off.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock