Question: How does a company account for the difference between interest expense and the cash payment of interest when bonds are issued at less than their

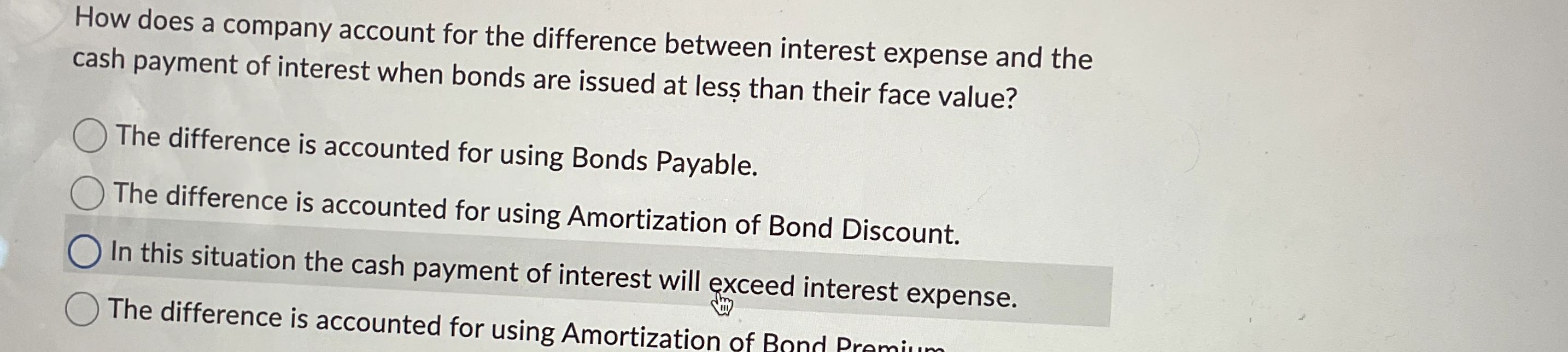

How does a company account for the difference between interest expense and the cash payment of interest when bonds are issued at less than their face value?

The difference is accounted for using Bonds Payable.

The difference is accounted for using Amortization of Bond Discount.

In this situation the cash payment of interest will exceed interest expense.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock