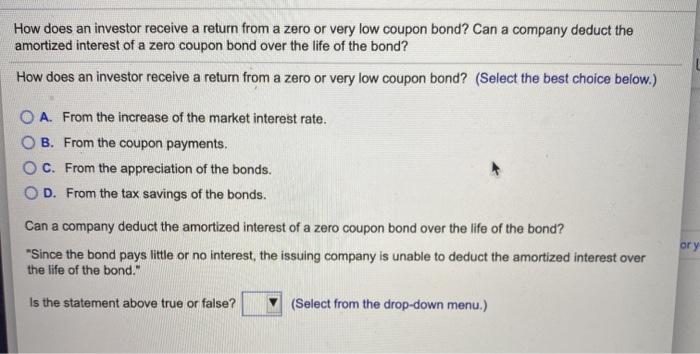

Question: How does an investor receive a return from a zero or very low coupon bond? Can a company deduct the amortized interest of a zero

How does an investor receive a return from a zero or very low coupon bond? Can a company deduct the amortized interest of a zero coupon bond over the life of the bond? How does an investor receive a return from a zero or very low coupon bond? (Select the best choice below.) O A. From the increase of the market interest rate. B. From the coupon payments. C. From the appreciation of the bonds. OD. From the tax savings of the bonds. Can a company deduct the amortized interest of a zero coupon bond over the life of the bond? "Since the bond pays little or no interest, the issuing company is unable to deduct the amortized interest over the life of the bond." ory Is the statement above true or false? (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts