Question: how does one get this? Bidder Inc. is taking over Target Inc. Bidder's price per share is $59. The number of shares outstanding of Bidder

how does one get this?

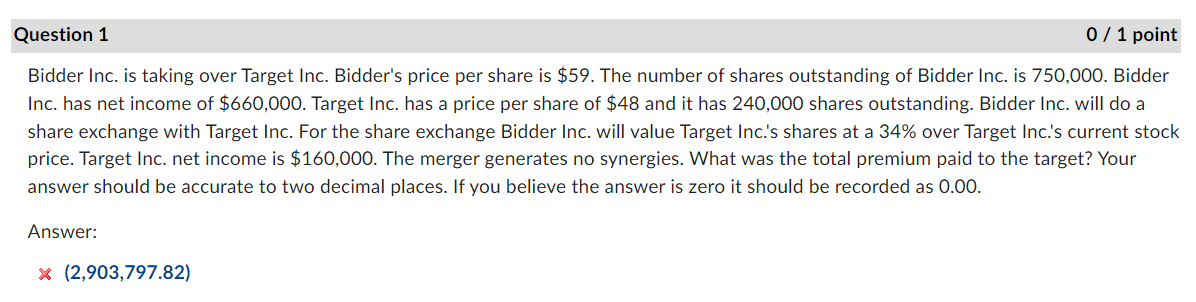

Bidder Inc. is taking over Target Inc. Bidder's price per share is $59. The number of shares outstanding of Bidder Inc. is 750,000 . Bidder Inc. has net income of $660,000. Target Inc. has a price per share of $48 and it has 240,000 shares outstanding. Bidder Inc. will do a share exchange with Target Inc. For the share exchange Bidder Inc. will value Target Inc.'s shares at a 34\% over Target Inc.'s current stock price. Target Inc. net income is $160,000. The merger generates no synergies. What was the total premium paid to the target? Your answer should be accurate to two decimal places. If you believe the answer is zero it should be recorded as 0.00. Answer: (2,903,797.82)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts