Question: How does the declaration of a cash dividend affect the accounting equation? A) increase to liabilities and a decrease to stockholders equity B) increase to

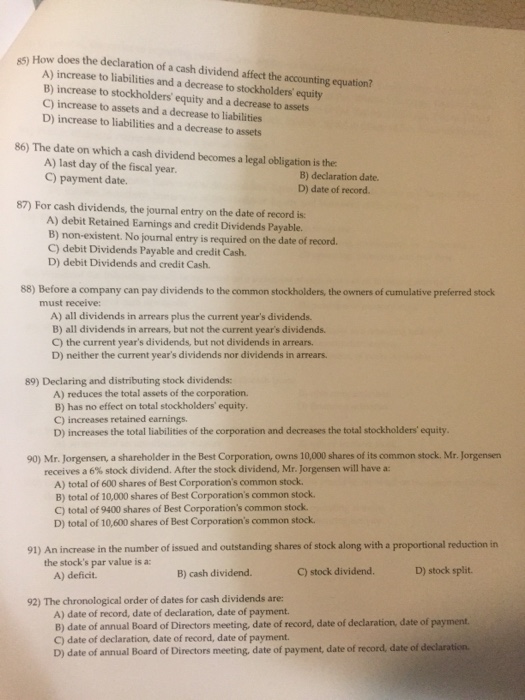

How does the declaration of a cash dividend affect the accounting equation? A) increase to liabilities and a decrease to stockholders equity B) increase to stockholder equity and a decrease to assets C) increase to assets and a decrease liabilities D) increase to liabilities and a decrease to assets The date on which a cash dividend becomes a legal obligation is the. A) last day of the fiscal year. B) declaration date. C) payment date. D) date of record. For cash dividends, the journal entry on the date of record is A) debit Retained Earnings and credit Dividends Payable. B) non-existent. No journal entry is required on the date of record. C) debit Dividends Payable and credit Cash. D) debit Dividends and credit Cash. Before a company can pay dividends to the common stockholders, the owners of cumulative preferred stock must receive: A) all dividends in arrears plus the current year's dividends. B) all dividends in arrears, but not the current year's dividends. C) the current year's dividends, but not dividends in arrears. D) neither the current year's dividends nor dividends in arrears. Declaring and distributing stock dividends: A) reduces the total assets of the corporation. B) has mi effect on total stockholders' equity. C) increases retained earnings D) increases the-total liabilities of the corporation and decreases the total stockholders' equity. Mr Jorgensen, a shareholder in the Best Corporation, owns 10,000 shares of its common stock. Mr. Jorgensen receives a 6% stock dividend. After the stock dividend, Mr. Jorgensen will have a: A) total of 600 shares of Best Corporation's common stock. B) total of 10,000 shares of Best Corporation's common stock. C) total of 9400 shares of Best Corporation's common stock. D) total of 10, 600 shares of Best Corporation's common stock. An increase in the number of issued and outstanding shares of stock along with a proportional reduction in the stock's par value is a: A) deficit. B) cash dividend. C) stock dividend. D) stock split. The chronological order of dates for cash dividends are: A) date of record, date of declaration, date of payment. B) date of annual Board of Directors meeting, date of record, date of declaration date of payment B) Data of declaration, date of record. date of payment. D) date. of annual Board of Directors meeting. date of payment. date of record, date of declaration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts