Question: How does the potential for losses in bond investments differ from that of equity investments in the event of a company's bankruptcy? Ooth bond and

How does the potential for losses in bond investments differ from that of equity investments in the event of a company's bankruptcy?

Ooth bond and equity holders lose an equal amount.

Bond holders usually lose more than equity holders.

Equity holders usually lose more than bond holders.

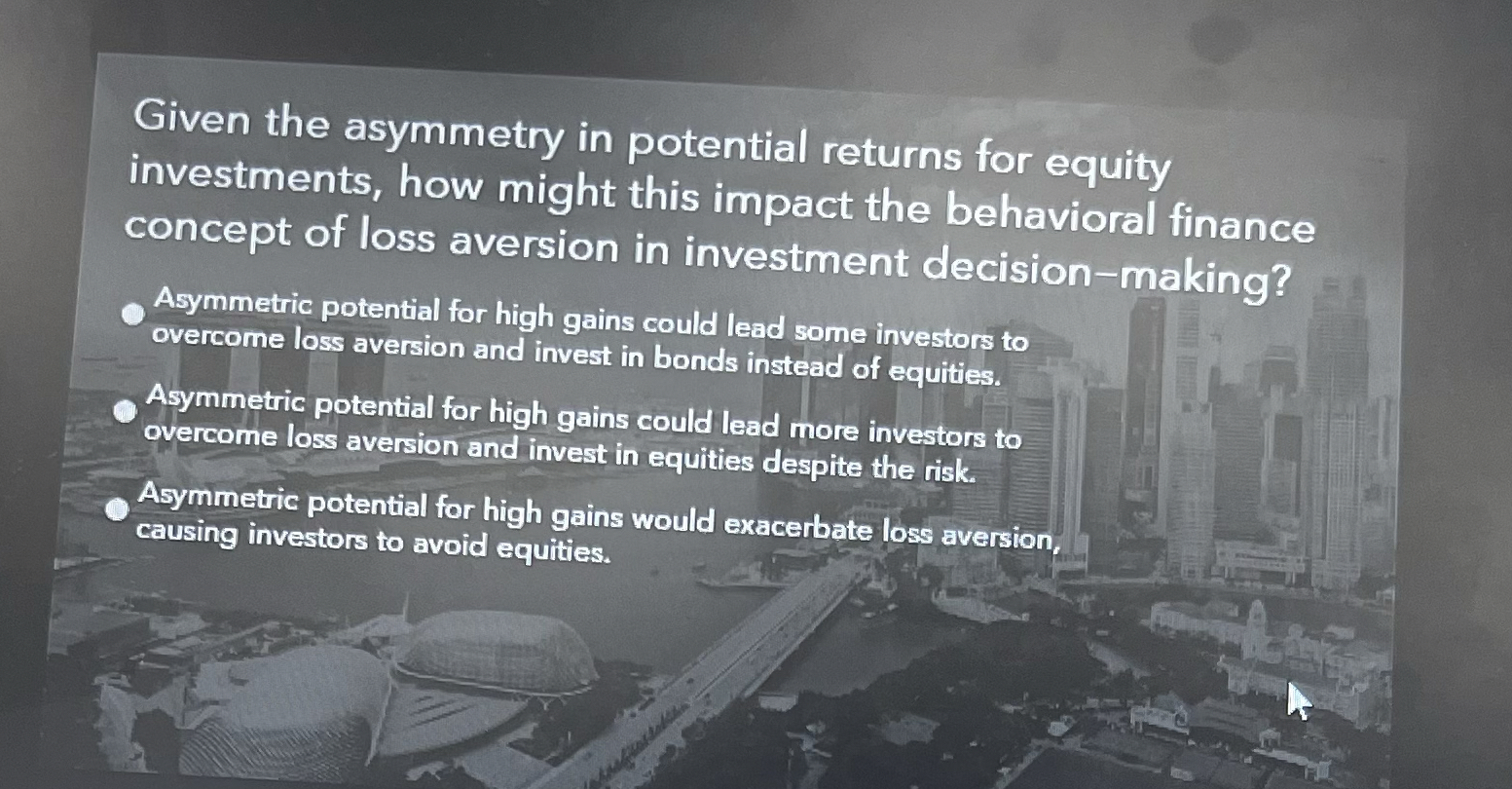

Given the asymmetry in potential returns for equity investments, how might this impact the behavioral finance concept of loss aversion in investment decisionmaking?

Asymmetric potential for high gains could lead some investors to overcome loss aversion and invest in bonds instead of equities.

Asymmetric potential for high gains could lead more investors to overcome loss aversion and invest in equities despite the risk.

Asymmetric potential for high gains would exacerbate loss aversion, causing investors to avoid equities.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock