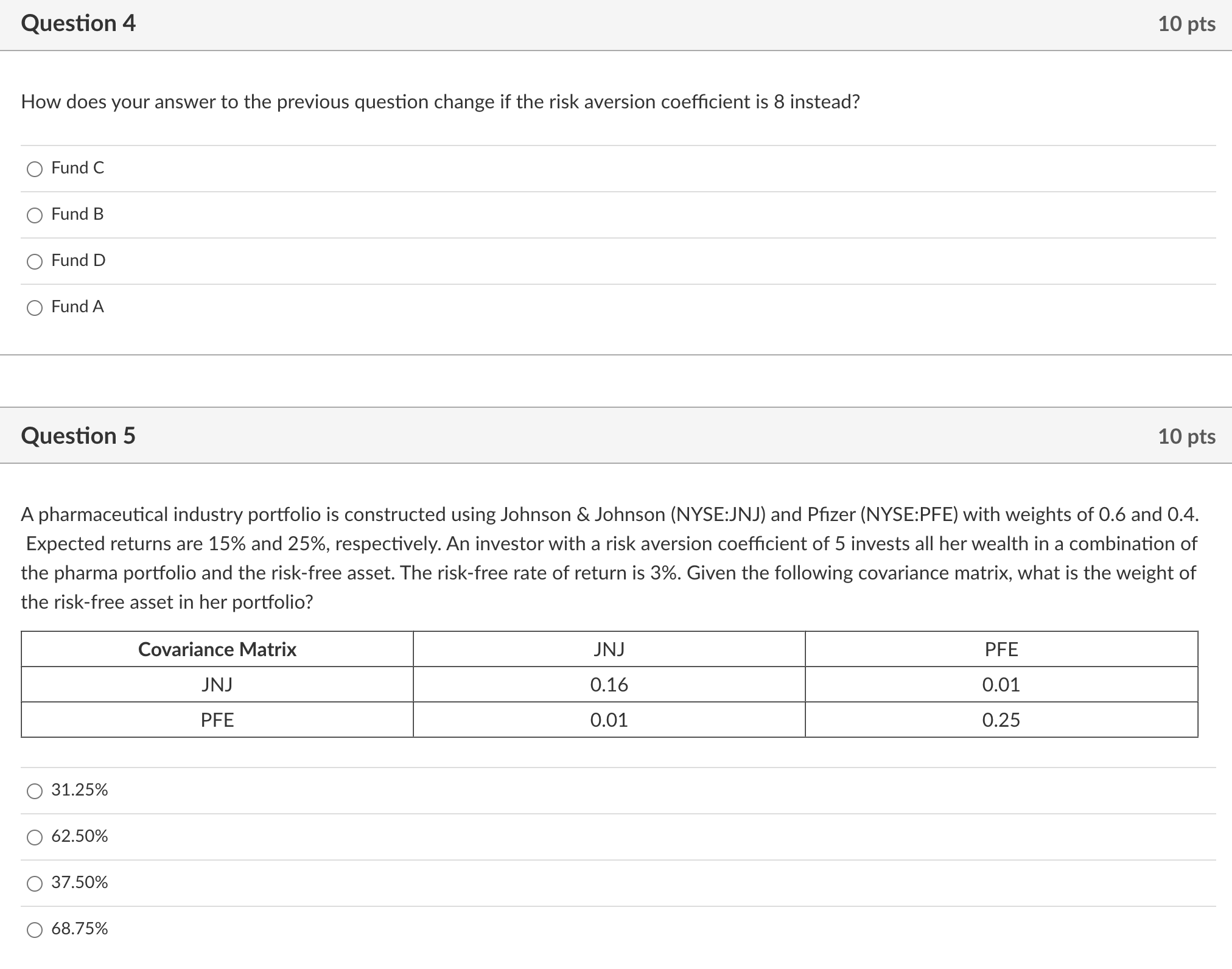

Question: How does your answer to the previous question change if the risk aversion coefficient is 8 instead? Fund C Fund B Fund D Fund A

How does your answer to the previous question change if the risk aversion coefficient is 8 instead? Fund C Fund B Fund D Fund A Question 5 10 pts A pharmaceutical industry portfolio is constructed using Johnson \& Johnson (NYSE:JNJ) and Pfizer (NYSE:PFE) with weights of 0.6 and 0.4. Expected returns are 15% and 25%, respectively. An investor with a risk aversion coefficient of 5 invests all her wealth in a combination of the pharma portfolio and the risk-free asset. The risk-free rate of return is 3%. Given the following covariance matrix, what is the weight of the risk-free asset in her portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts