Question: How is p calculated? Excel can be used. I found that it is the same as the multiple R, but I don't know if that

How is p calculated? Excel can be used. I found that it is the same as the multiple R, but I don't know if that is correct.

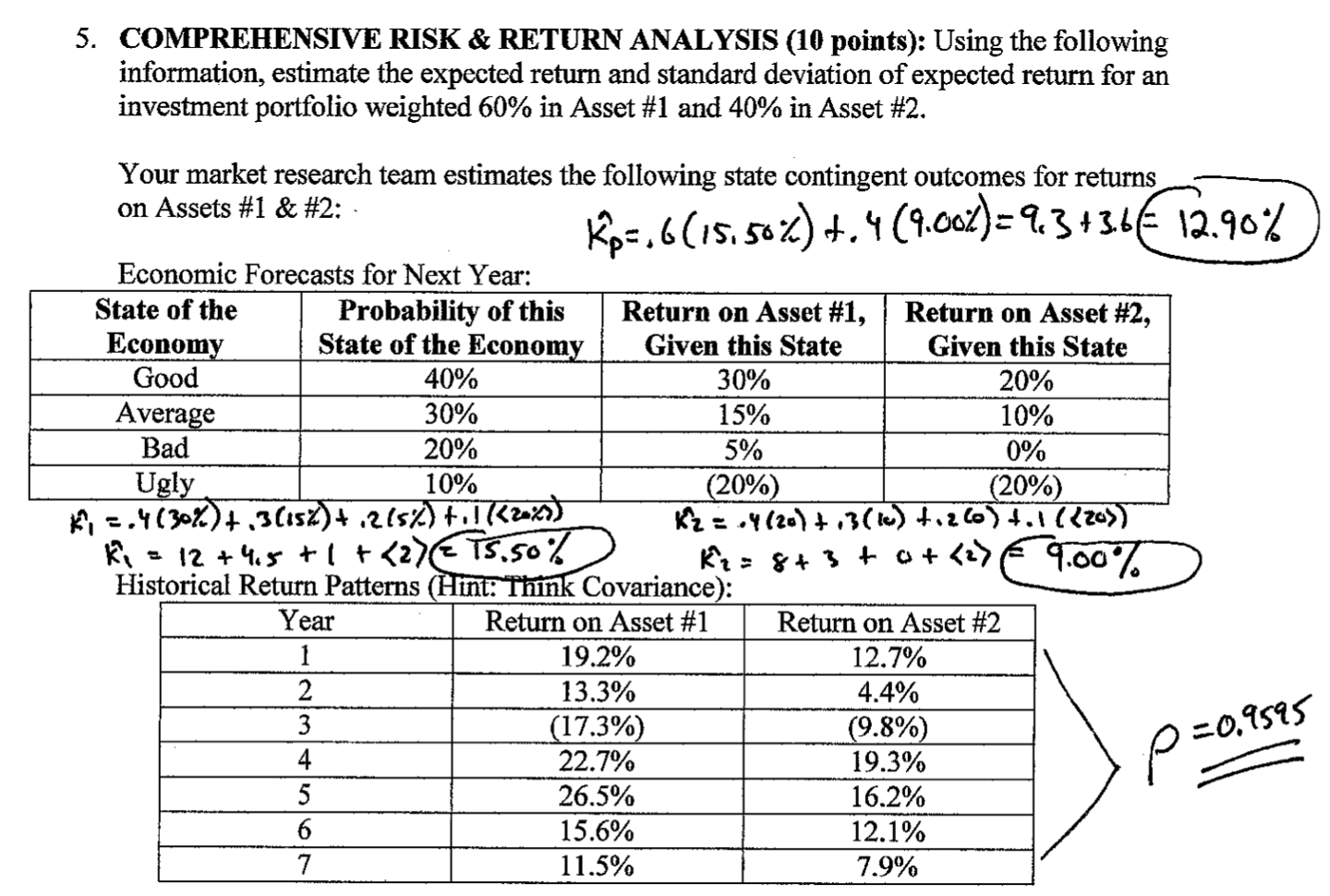

5. COMPREHENSIVE RISK & RETURN ANALYSIS (10 points): Using the following information, estimate the expected return and standard deviation of expected return for an investment portfolio weighted 60% in Asset #1 and 40% in Asset #2. 30% Your market research team estimates the following state contingent outcomes for returns on Assets #1 & #2: - Ko-,6(15.50%) +.469.002)=93736 12.90%) Economic Forecasts for Next Year: State of the Probability of this Return on Asset #1, Return on Asset #2, Economy State of the Economy Given this State Given this State Good 40% 20% Average 30% 15% 10% Bad 20% 5% 0% Ugly 10% (20%) (20%) K, =.4630%) +,3(152) 4.215%) 1(227) KZ = 4(20) .3(te) tozlo) 7.1 (120) ki = 12 +4.5+ 1 + 9.00% Historical Return Patterns (Hint: Think Covariance): Year Return on Asset #1 Return on Asset #2 19.2% 12.7% 13.3% 4.4% (17.3%) (9.8%) 22.7% 19.3% 26.5% 16.2% 15.6% 12.1% 11.5% 7.9% p=0.9595

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts