Question: How is preferred stock with no fixed maturity typically valued? It is valued based on fluctuations in the stock market price. It is valued by

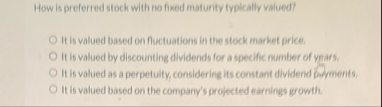

How is preferred stock with no fixed maturity typically valued?

It is valued based on fluctuations in the stock market price.

It is valued by discounting dividends for a specific number of ya ars.

It is valued as a perpetuily, considering its constant dividend farments.

It is valued based on the company's projected earnings growth.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock